Revenue Act of 1924

The United States Revenue Act of 1924 (43 Stat. 253) (June 2, 1924), also known as the Mellon tax bill cut federal tax rates and established the U.S. Board of Tax Appeals, which was later renamed the United States Tax Court in 1942. The bill was named after U.S. Secretary of the Treasury Andrew Mellon.

The Revenue Act was applicable to incomes for 1924.[1]

The bottom rate, on income under $4,000, fell from 1.5% to 1.125% (both rates are after reduction by the "earned income credit").

A parallel act, the Indian Citizenship Act of 1924 (43 Stat. 253, Ch. 233 (1924)), granted all non-citizen resident Indians citizenship.[2] Thus the Revenue Act declared that there were no longer any "Indians, not taxed" to be not counted for purposes of United States Congressional apportionment.

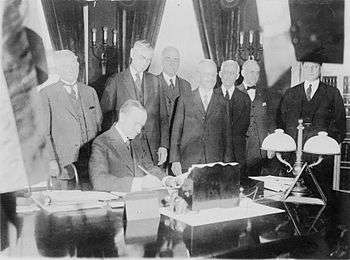

President Calvin Coolidge signed the bill into law.

Tax on Individuals

A Normal Tax and a Surtax were levied against the net income of individuals as shown in the following table.

| Revenue Act of 1924 Normal Tax and Surtax on Individuals | |||

| Net Income (dollars) |

Normal Rate (percent) |

Surtax Rate (percent) |

Combined Rate (percent) |

| 0 | 2 | 0 | 2 |

| 4,000 | 4 | 0 | 4 |

| 8,000 | 6 | 0 | 6 |

| 10,000 | 6 | 1 | 7 |

| 14,000 | 6 | 2 | 8 |

| 16,000 | 6 | 3 | 9 |

| 18,000 | 6 | 4 | 10 |

| 20,000 | 6 | 5 | 11 |

| 22,000 | 6 | 6 | 12 |

| 24,000 | 6 | 7 | 13 |

| 26,000 | 6 | 8 | 14 |

| 28,000 | 6 | 9 | 15 |

| 30,000 | 6 | 10 | 16 |

| 34,000 | 6 | 11 | 17 |

| 36,000 | 6 | 12 | 18 |

| 38,000 | 6 | 13 | 19 |

| 42,000 | 6 | 14 | 20 |

| 44,000 | 6 | 15 | 21 |

| 46,000 | 6 | 16 | 22 |

| 48,000 | 6 | 17 | 23 |

| 50,000 | 6 | 18 | 24 |

| 52,000 | 6 | 19 | 25 |

| 56,000 | 6 | 20 | 26 |

| 58,000 | 6 | 21 | 27 |

| 62,000 | 6 | 22 | 28 |

| 64,000 | 6 | 23 | 29 |

| 66,000 | 6 | 24 | 30 |

| 68,000 | 6 | 25 | 31 |

| 70,000 | 6 | 26 | 32 |

| 74,000 | 6 | 27 | 33 |

| 76,000 | 6 | 28 | 34 |

| 80,000 | 6 | 29 | 35 |

| 82,000 | 6 | 30 | 36 |

| 84,000 | 6 | 31 | 37 |

| 88,000 | 6 | 32 | 38 |

| 90,000 | 6 | 33 | 39 |

| 92,000 | 6 | 34 | 40 |

| 94,000 | 6 | 35 | 41 |

| 96,000 | 6 | 36 | 42 |

| 100,000 | 6 | 37 | 43 |

| 200,000 | 6 | 38 | 44 |

| 300,000 | 6 | 39 | 45 |

| 500,000 | 6 | 40 | 46 |

- Exemption of $1,000 for single filers and $2,500 for married couples and heads of family. A $400 exemption for each dependent under 18.