Bertrand competition

Bertrand competition is a model of competition used in economics, named after Joseph Louis François Bertrand (1822–1900). It describes interactions among firms (sellers) that set prices and their customers (buyers) that choose quantities at the prices set. The model was formulated in 1883 by Bertrand in a review of Antoine Augustin Cournot's book Recherches sur les Principes Mathematiques de la Theorie des Richesses (1838) in which Cournot had put forward the Cournot model.[1] Cournot argued that when firms choose quantities, the equilibrium outcome involves firms pricing above marginal cost and hence the competitive price. In his review, Bertrand argued that if firms chose prices rather than quantities, then the competitive outcome would occur with price equal to marginal cost. The model was not formalized by Bertrand: however, the idea was developed into a mathematical model by Francis Ysidro Edgeworth in 1889.[2]

The model rests on very specific assumptions. There are at least two firms producing a homogeneous (undifferentiated) product and can not cooperate in any way. Firms compete by setting prices simultaneously and consumers want to buy everything from a firm with a lower price (since the product is homogeneous and there are no consumer search costs). If two firms charge the same price, consumers demand is split evenly between them. It is simplest to concentrate on the case of duopoly where there are just two firms, although the results hold for any number of firms greater than 1.

A crucial assumption about the technology is that both firms have the same constant unit cost of production, so that marginal and average costs are the same and equal to the competitive price. This means that as long as the price it sets is above unit cost, the firm is willing to supply any amount that is demanded (it earns profit on each unit sold). If price is equal to unit cost, then it is indifferent to how much it sells, since it earns no profit. Obviously, the firm will never want to set a price below unit cost, but if it did it would not want to sell anything since it would lose money on each unit sold.

The Bertrand duopoly equilibrium

Why is the competitive price a Nash equilibrium in the Bertrand model? First, if both firms set the competitive price with price equal to marginal cost (unit cost), neither firm will earn any profits. However, if one firm sets price equal to marginal cost, then if the other firm raises its price above unit cost, then it will earn nothing, since all consumers will buy from the firm still setting the competitive price (recall that it is willing to meet unlimited demand at price equals unit cost even though it earns no profit). No other price is an equilibrium. If both firms set the same price above unit cost and share the market, then each firm has an incentive to undercut the other by an arbitrarily small amount and capture the whole market and almost double its profits. So there can be no equilibrium with both firms setting the same price above marginal cost. Also, there can be no equilibrium with firms setting different prices. The firms setting the higher price will earn nothing (the lower priced firm serves all of the customers). Hence the higher priced firm will want to lower its price to undercut the lower-priced firm. Hence the only equilibrium in the Bertrand model occurs when both firms set price equal to unit cost (the competitive price).[3]

Note that the Bertrand equilibrium is a weak Nash-equilibrium. The firms lose nothing by deviating from the competitive price: it is an equilibrium simply because each firm can earn no more than zero profits given that the other firm sets the competitive price and is willing to meet all demand at that price.

Calculating the classic Bertrand model

- MC = constant marginal cost (equals constant unit cost of production).

- p1 = firm 1’s price level

- p2 = firm 2’s price level

- pM = monopoly price level

Firm 1's optimum price depends on where it believes firm 2 will set its prices. Pricing just below the other firm will obtain full market demand (D), though this is not optimal if the other firm is pricing below marginal cost as that would entail negative profits. In general terms, firm 1's best response function is p1’’(p2), this gives firm 1 optimal price for each price set by firm 2.

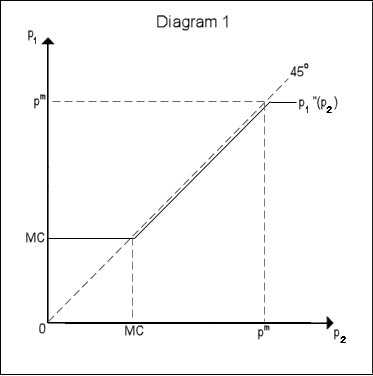

Diagram 1 shows firm 1’s reaction function p1’’(p2), with each firm's strategy on each axis. It shows that when P2 is less than marginal cost (firm 2 pricing below MC) firm 1 prices at marginal cost, p1=MC. When firm 2 prices above MC but below monopoly prices, then firm 1 prices just below firm 2. When firm 2 prices above monopoly prices (PM) firm 1 prices at monopoly level, p1=pM.

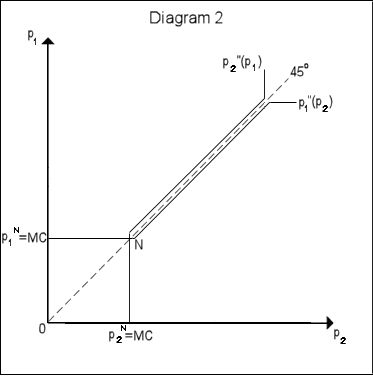

Because firm 2 has the same marginal cost as firm 1, its reaction function is symmetrical with respect to the 45 degree line. Diagram 2 shows both reaction functions.

The result of the firms' strategies is a Nash equilibrium, that is, a pair of strategies (prices in this case) where neither firm can increase profits by unilaterally changing price. This is given by the intersection of the reaction curves, Point N on the diagram. At this point p1=p1’’(p2), and p2=p2’’(p1). As you can see, point N on the diagram is where both firms are pricing at marginal cost.

Another way of thinking about it, a simpler way, is to imagine if both firms set equal prices above marginal cost, firms would get half the market at a higher than MC price. However, by lowering prices just slightly, a firm could gain the whole market, so both firms are tempted to lower prices as much as they can. It would be irrational to price below marginal cost, because the firm would make a loss. Therefore, both firms will lower prices until they reach the MC limit.

If one firm has lower average cost (a superior production technology), it will charge the highest price that is lower than the average cost of the other one (i.e. a price just below the lowest price the other firm can manage) and take all the business. This is known as "limit pricing"

Critical analysis of the Bertrand model

The Bertrand model rests on some very extreme assumptions. For example, it assumes that consumers want to buy from the lowest priced firm. There are various reasons why this may not hold in many markets: non-price competition and product differentiation, transport and search costs. For example, would someone travel twice as far to save 1% on the price of their vegetables? The Bertrand model can be extended to include product or location differentiation but then the main result – that price is driven down to marginal cost – no longer holds. With search costs, there may be other equilibria apart from the competitive price – the monopoly price or even price dispersion may be equilibria as in the classic "Bargains and Rip-offs" model.[4]

The model also ignores capacity constraints. If a single firm does not have the capacity to supply the whole market then the "price equals marginal cost" result may not hold. The analysis of this case was started by Francis Ysidro Edgeworth and has become known as the Bertrand–Edgeworth model. With capacity constraints, there may not exist any pure strategy Nash equilibrium, the so-called Edgeworth paradox. However, in general there will exist a mixed-strategy Nash equilibrium as shown by Huw Dixon[5]

There is a big incentive to cooperate in the Bertrand model: colluding to charge the monopoly price and sharing the market each is the best that the firms could do in this set up. However not colluding and charging marginal cost, is the non-cooperative outcome and the only Nash equilibrium of this model. If we move from a one-shot game to a repeated game, then perhaps collusion can persist for some time or emerge.

Bertrand competition versus Cournot competition

Neither model is necessarily "better" than the other. The accuracy of the predictions of each model will vary from industry to industry, depending on the closeness of each model to the industry situation. If capacity and output can be easily changed, Bertrand is generally a better model of duopoly competition. If output and capacity are difficult to adjust, then Cournot is generally a better model. Under some conditions the Cournot model can be recast as a two-stage model, where in the first stage firms choose capacities, and in the second they compete in Bertrand fashion.

Bertrand predicts a duopoly is enough to push prices down to marginal cost level; a duopoly will result in an outcome exactly equivalent to what prevails under perfect competition.

References

- ↑ Bertrand, J. (1883) "Book review of theorie mathematique de la richesse sociale and of recherches sur les principles mathematiques de la theorie des richesses", Journal de Savants 67: 499–508

- ↑ Edgeworth, Francis (1889) “The pure theory of monopoly”, reprinted in Collected Papers relating to Political Economy 1925, vol.1, Macmillan.

- ↑ Narahari, Y.; Garg, Dinesh; Narayanam, Ramasuri; Prakash, Hastagiri (2009), Game Theoretic Problems in Network Economics and Mechanism Design Solutions, Springer, p. 21, ISBN 978-1-84800-937-0

- ↑ Salop S and Stiglitz J (1977) Bargains and Ripoffs: A Model of Monopolistically Competitive Price Dispersion, The Review of Economic Studies, Vol. 44, No. 3 (Oct., 1977), pp. 493–510

- ↑ Dixon H (1984) The existence of mixed-strtaegy equilibria in a price-setting oligopoly with convex costs, Economics Letters, volume 16, pages 205–212.

Further reading

- Oligoply Theory made Simple, Chapter 6 of Surfing Economics by Huw Dixon.

- The Pure Theory of Monopoly, Francis Edgeworth

- Bertrand's review of Walras and Cournot

See also

- Aggregative game

- Conjectural variation

- Cournot competition

- Differentiated Bertrand competition

- Stackelberg competition

- Nash equilibrium

- Game theory

- Bertrand paradox (economics)

- Bertrand–Edgeworth model

- Edgeworth paradox