Segmenting and positioning

"One of the most important strategic concepts, contributed by the marketing discipline to business firms and other types of organizations, is that of market segmentation".[1] Market Segmentation is a process, in which groups of buyers within a market are divided and profiled according to a range of variables, which determine the market characteristics and tendencies.[2] The process of Segmentation is part of a chronological order, which follows on to include Targeting and Positioning. Targeting is the process of identifying the most attractive segments from the segmentation stage, usually the ones most profitable for the business.[2] Positioning is the final process, and is the more business-orientated stage, where the business must assess its competitive advantage and position itself in the consumer’s minds to be the more attractive option in these categories.[2]

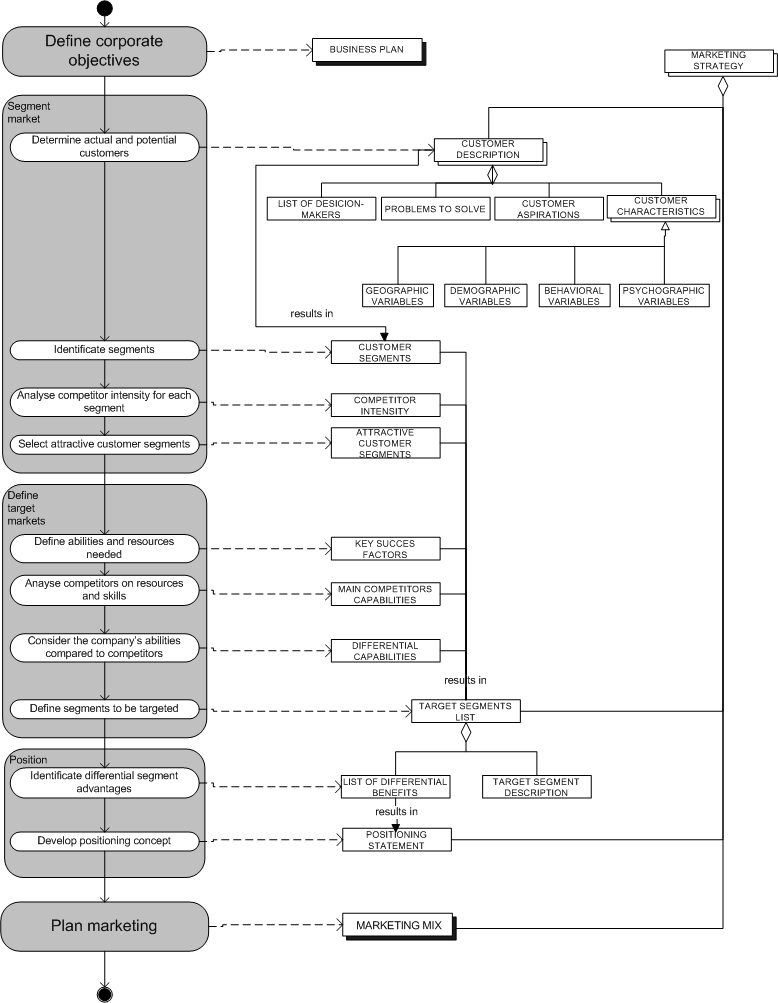

The process-data model

Below a generic process-data model is given for the whole process of segmenting and positioning as a basis of deciding on the most effective marketing strategy and marketing mix.

This model consists of the three main activities: segmenting, targeting and positioning. It shows the chronological dependency of the different activities. On the right side of the model the concepts resulting from the activities are shown. The arrows show that one concept results from one or more previous concepts; the concept can not be made when the previous activities have not taken place. Below the three main activities are shortly described as well as their role as a basis for the next step or their dependency on the previous step.

Segmenting

Segmenting a market has widely been debated over the years as researchers have argued over what variables to consider when dividing the market. Approaches through social, economic and individual factors, such as brand loyalty, have been considered[3] along with the more widely recognized geographic, physiographic, demographic and behavioral variables proposed by Philip Kotler.[4] Segmenting a market therefore, is a process of organising the market into groups that a business can gain a competitive advantage in. They must, however, avoid over-fragmenting the market as the diversity can make it difficult to profitably serve the smaller markets.[5] The characteristics marketers are looking for are measurability, accessibility, sustainability and actionability.

Measurability – The understanding of size, purchasing characteristics and value needs of a particular segment

Accessibility – The ability to communicate with the segment in an effective manner

Sustainability – The segment is profitable enough to differentiate itself from other segments in the market and maintains the value the business offers.

Actionability – The capability of an organization to create a competitive advantage with its offering in the specific segment of the market[5]

There are two approaches to segmenting a market - a discovery approach or an analytic approach. Each approach is appropriate to the type of business and market they are approaching.[6]

An analytic approach is a much more research and data based approach, where two sets of information are derived and used to segment the market.[5] The two approaches give the business an idea for the future profitability of a segment, and the tendencies and behaviours it portrays. The first approach gives them an idea on the future growth of the segment, and whether its investment outcome is worthwhile. This, therefore, will usually be done in advance. The second approach is more based around the observation of the buying behaviours of the segment and is more based around primary research.[5]

The discovery approach is more suited to a market with a limited customer base, and the process of discovering segments is based on interest in the offer or a similar offer the business may be able to provide.[5] Because of this, a discovery-based approach is a much timelier process by which to determine the profitable segments. Both approaches can benefit from elements of the other and, in most situations, work well in unison with each other when determining a profitable and defined segment.[5]

Market Segmentation

Creating segments

“Market-segmentation research and practice has a long history, and the breadth and success of segmentation applications continues to flourish, with novel and unorthodox profiling applications now reaching beyond the boundaries of a traditional marketing focus”. (Quinn, L., Dibb, S. 2010)

Market-segmentation research has the power to identify the target consumers an organisation should prioritise and target. Market Segmentation can be achieved with 5 steps focusing on the core elements of the segmentation.

Step 1:

Define your target market, trends and scope of segmentation.

It is important to target the target market for the product being sold as consumers that are not within the target market are variables that do not provide any useful information for your organisation. It is important to try and comprehend why the customer is within this specific segment. What are their goals or purpose for being within this market? What are they likely to be chasing within this segment?

By uncovering what the consumers need is the organisation can look to satisfy this need and by doing so better position themselves to approach this market segment. Identifying other products that match the needs of your consumer is important as well as they will need to be evaluated and analysed because of the threat they pose to your specific target market.

It is crucial to ensure that as you are understanding the target segment that you are also adjusting your company scope in order to match it with your company objectives and capabilities. If the organisation is not satisfying the consumer need it has identified it will likely fail as consumer needs will not be met.

By specifying geographical limitations, organisations can create a scope that is applicable in their specific domestic position. Organisations should work to segment areas that are within its areas of operating capability as segmenting areas that aren’t realistically available represents opportunities that will be able to be utilised either way.

Step 2:

Perceptual Mapping and Market Mapping

“A market map defines the distribution and value added chain between final users and suppliers which takes into account the various buying mechanisms found in a market, including the part played by ‘influencers’”. (Mcdonald, M., Dunbar, I. 2012). Market Mapping is essential to correctly determine the specific market that should be analysed and the people who should be segmented. This model aids the identification of target consumers from Suppliers, Distributors, Retailers and Final Users. This includes the high potential market segments and what the size of it is.

Perceptual mapping is especially important as it creates a visual diagram of the range of products being offered within a segment. Traditionally the perceptual map will consist of 4 headings; the basic elements of this map includes Low or High Quality and Low or High Price but these can be changed and altered based on specific product attributes e.g. A soft drink producer may want to evaluate a perceptual map including traits such as High or Low in Caffeine and High or low in Sugar in their specific market segment. Different segments will have different traits and attributes that will need to be evaluated to determine where an organisation will position themselves. ‘Conceptualising market segmentation as performative enhances knowledge of how marketing frameworks shape marketing’ (Venter, P., Wright, A., Dibb, S. 2015).

By divulging where competitors are positioned within the market map it is possible to see attractive segments of the market that may be worthwhile occupying. This is where you can begin to form an idea of where you will be able to hit the market as you can see which areas of the market are left untouched or not utilised to its maximum potential.

Step 3:

Construct a Model of the market.

A market is composed of customers who have spending trends that are different from those of other people. It is important to identify these trends and how they come into play within your market model. Transactions made can offer a lot of information about the consumer and it is important that this information is utilized in order to gain the greatest knowledgeable advantage available to your organisation. “It requires you to record the key features sought by the market when deciding between competing offers. These are selected from the actual product and services on offer (what is bought) and from the options presented by where it can be bought when it is bought and how”. (Mcdonald, M., Dunbar, I. 2012).

It also includes definitions of the product or service: what it comprises or consists of. By identifying characteristics and properties of a purchase as well as decisions which are made at the time of purchase, organisations can more accurately gauge the personalities and needs of their consumers.

By identifying these aspects of consumers, consumers will be able to be placed into separate categories or groups which are easily identifiable (relative to the organisation). Consumers which are in categories become easier to satisfy as it is easier to establish their needs. Wealth, Age, Life Stage, Budget, Socioeconomic factors, background & job are all relative factors that need to be considered when categorising populations into groups (Evans, M. 2009). It is important to micro segment these consumers into categories which fit with the organisational scope as these details are significant to the organisation. It is imperative to note that when looking through relative factors, organisations should look to find Key Discriminating Features within these factors to identify which factors will be important for making meaningful differences. “A meaningful difference occurs when some of the customers within a group would not respond positively to an offer consisting of the key discriminating features listed for them.” (Mcdonald, M., Dunbar, I. 2012). Appropriate segments can then be targeted to place differing levels of interest amongst features the product has to offer. Segments can be rated to signify how well a specific feature will perform within that segment.

Developing a good range of micro segments is essential as it must be representative of the current market. Once completed this transactional information can assist decision making on selected a micro segment that is fitting for the organisational scope and purpose.

Step 4:

Identifying Segments

Consumers at this stage can be examined and observed to reveal key information that drives their consumerism. After selecting attractive micro segments it is important to think about the Key discriminating features for these segments. What needs need to be fulfilled? This question is imperative to selecting the right segment as the need of the customer is reflected in their Decisive Buying Criteria. “Decisive buying criteria are the attributes of a purchase that customers evaluate when choosing between alternative offers”. (Mcdonald, M., Dunbar, I. 2012)

Features of the product must relate to some sort of benefit for the consumer e.g. a feature of a remote controller is the ‘off’ switch. By switching off the device using a controller instead of manually doing it, time is saved thus resulting in a benefit.

Once consumer needs and benefits have been thoroughly analysed and understood, the value the consumer perceives can be generated and from this prices can be established and value can be assigned to the features of the product. By having a value assigned with key features for particular segments, needs, prices and benefits can be more readily and easily calculated thus allowing for a more accurate market segment analysis. Once the appropriate markets have been analysed and compared, appropriate segments will be identifiable for the organisation to pursue.

Step 5:

Segmenting

Similar micro segments can be grouped as bigger segments if they satisfy the same need, segments must comprise only features that are the almost the same or extremely similar.

Consumers can now be grouped via their characteristics to form a ‘segment’. These characteristics include all information that was obtained during steps 1-4 to create specific segments of consumers that all have the same kind of needs, wants, and benefits received from the specific product within their segment.

Analysing competitor intensity within segments and finding attractive segments for your particular product is crucial to business success because of how competitors may be positioned themselves inside the market. By ensuring that the organisation is within the correct segment, success levels become higher as companies are more likely to effectively meet consumer demands within the specified segment and in turn make a higher amount of profit. It is critical that segments are the correct size for the companies’ capabilities as segments that are too big or too little will most likely yield negative results.

Once all segments are sorted into their respective groups organisations can have a clear look at the amount of individuals within each formed group and their specific decisive buying criteria and can begin to make an informed decision on which segment to pursue.

Selecting segments based on Attractiveness

Identifying key segments relevant to your organisation.

It is important to define the specific criteria that your organisation is searching for within consumers in order to determine how attractive specific segments are for your organisation. Each Segment contains different types of consumers with different needs so it is crucial that your organisation chooses the correct segment that aligns itself with organisational criteria. By choosing the right segment for organisation criteria, company goals and segments align allowing for a higher chance of success within that segment. “An overall attractiveness score is then calculated for each concluding segment based on how well each of them satisfies your company requirements”. (Mcdonald, M. 2008). At this point attractive segments are now clearly visible and by choosing a segment that is fitting for an organisation we can guarantee a higher success rate for the specified product.

Different approaches must be taken for different segments in the market. It is important to take into account other factors that may influence your position when approaching the selected segment. Organisational competition can be fierce when targeting a segment that is already occupied with several organisations. By this section of segment selection, company objectives and criteria will align with the specified segment and this can be used to create a strategic plan for your organisation to tackle this specific segment and fulfil corporate goals.

Targeting

Targeting is a follow on process from segmentation, and is the process of actually determining the select markets and planning the advertising media used to make the segment appealing.[6] Targeting is a changing environment. Traditional targeting practices of advertising through print and other media sources, has made way for a social media presence, leading a much more ‘web-connected’ focus.[7] Behavioural targeting is a product of this change, and focuses on the optimization of online advertising and data collection to send a message to potential segments. This process is based around the collection of ‘cookies’, small pieces of information collected by a consumer’s browser and sold to businesses to identify potential segments to appeal to.[6] For example, someone consistently accessing photography based searches is likely to have advertisements for camera sales appear, due to the cookie information they deliver showing an interest in this area.[8] Whilst targeting a market, there are three different market coverage choices to consider - undifferentiated, differentiated and niche marketing.[8] Choosing which targeting choice to pursue depends on the product or service being offered. Undifferentiated marketing is the best option to focus on the market as a whole and to promote products that have a wide target segment, whilst differentiated and niche marketing are more specialized and focus on smaller, more selective segments.[8]

Positioning

Positioning is the final stage in the ‘STP’ process and focuses on how the customer ultimately views your product or service in comparison to your competitors and is important in gaining a competitive advantage in the market.[8] Therefore, customer perceptions have a huge impact on the brands positioning in the market. There are three types of positioning that are key in positioning the brand to a competitive advantage; these are Functional Positioning, Symbolic Positioning, and Experiential positioning.[8] Functional Positioning is focused on the aspects of the products or services that can fulfill consumers’ needs or desires. Symbolic Positioning is based on the characteristics of the brand that fulfill customers’ self-esteem. Experiential positioning is based around the characteristics of the brands that stimulate the sensory or emotional connection with the customers. A combination of the three is key to positioning the brand at a competitive advantage to its immediate competition.[5] Overall, positioning should provide better value than competitors and communicate this differentiation in an effective way to the consumer.[9]

B2C and B2B

The process described above can be used for both business-to-customer as well as business-to-business marketing. Although most variables used in segmenting the market are based on customer characteristics, business characteristics can be described using the variables which are not depending on the type of buyer. There are however methods for creating a positioning statement for both B2C and B2B segments. One of these methods is MIPS: a method for managing industrial positioning strategies by Muhlbacher, Dreher and Gabriel-Ritter (1994).

See also

customer evaluation matrix

MIPS: Managing Industrial Positioning Strategies the image of the

References

- ↑ Myers, C (1996). Trust, commitment and values shared in long‐term relationships in the services marketing industry. University of Nevada.

- 1 2 3 Bowen, John (1998). Market segmentation in hospitality research: no longer a sequential process.

- ↑ Jain, S C (1993). Marketing, Planning and Strategy. Cincinnati, OH, United States: South-Western Publishing Co.

- ↑ Kotler, Philip (1997). Marketing Management Analysis, Planning, Implementation, and Control. New Jersey: Prentice Hall International.

- 1 2 3 4 5 6 7 Vitale, Robert; Giglierano, Joseph (2002). Business to Business Marketing. Mason, Ohio: South-Western publishing.

- 1 2 3 Levens, Michael (2012). Marketing: Defined, Explained, Applied. New Jersey: Pearson Education Inc.

- ↑ Jaworska, Joanna; Sydow, Marcin (2008). Web Information Systems Engineering - WISE 2008. Warszawa: Springer Berlin Heidelberg. pp. 62–76.

- 1 2 3 4 5 Klever, Alice (2009). Behavioural Targeting: An Online Analysis for Efficient Media Planning?. Hamburg, Germany: Diplomica Verlag.

- ↑ Kotler, Philip (1999). Kotler on Marketing: How to create, win and dominate markets. New York, United States: The Free Press.

External links

B2B Marketing Org - How to develop a positioning statement