Secular stagnation theory

The secular stagnation theory was originally put forth by Alvin Hansen in 1938 to "describe what he feared was the fate of the American economy following the Great Depression of the early 1930s: a check to economic progress as investment opportunities were stunted by the closing of the frontier and the collapse of immigration".[1][2]

Warnings similar to secular stagnation theory have been issued after all deep recessions, but they usually turned out to be wrong because they underestimated the potential of existing technologies.[3]

Secular stagnation refers to "a condition of negligible or no economic growth in a market-based economy".[4] In this context, the term secular is used in contrast to cyclical or short-term, and suggests a change of fundamental dynamics which would play out only in its own time. Alan Sweezy described the difference:

"But, whereas business-cycle theory treats depression as a temporary, though recurring, phenomenon, the theory of secular stagnation brings out the possibility that depression may become the normal condition of the economy." [5]

According to Seymour Harris (1943) "the idea of secular stagnation runs through much of Keynes General Theory".

Stagnation and the financial explosion: The 1980s

A prescient analysis of stagnation and what is now called financialization was provided in the 1980s by Harry Magdoff and Paul Sweezy, coeditors of the independent socialist journal Monthly Review. Magdoff was a former economic advisor to Vice President Henry A. Wallace in Roosevelt’s New Deal administration, while Sweezy was a former Harvard economics professor. In their 1987 book, Stagnation and the Financial Explosion, they argued, based on Keynes, Hansen, Michał Kalecki, and Marx, and marshaling extensive empirical data, that, contrary to the usual way of thinking, stagnation or slow growth was the norm for mature, monopolistic (or oligopolistic) economies, while rapid growth was the exception.[6]

Private accumulation had a strong tendency to weak growth and high levels of excess capacity and unemployment/underemployment, which could, however, be countered in part by such exogenous factors as state spending (military and civilian), epoch-making technological innovations (for example, the automobile in its expansionary period), and the growth of finance. In the 1980s and 1990s Magdoff and Sweezy argued that a financial explosion of long duration was lifting the economy, but this would eventually compound the contradictions of the system, producing ever bigger speculative bubbles, and leading eventually to a resumption of overt stagnation.

Japan 1991-present

Japan has been suffering economic or secular stagnation for most of the period since the early 1990s.[7][8]

2008–2009

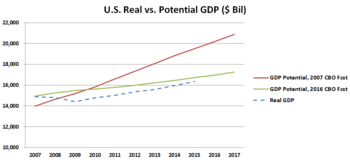

Economists have asked whether the low economic growth rate in the developed world leading up to and following the subprime mortgage crisis of 2007-2008 was due to secular stagnation. Paul Krugman wrote in September 2013: "[T]here is a case for believing that the problem of maintaining adequate aggregate demand is going to be very persistent – that we may face something like the 'secular stagnation' many economists feared after World War II." Krugman wrote that fiscal policy stimulus and higher inflation (to achieve a negative real rate of interest necessary to achieve full employment) may be potential solutions.[9]

Larry Summers presented his view during November 2013 that secular (long-term) stagnation may be a reason that U.S. growth is insufficient to reach full employment: "Suppose then that the short term real interest rate that was consistent with full employment [i.e., the "natural rate"] had fallen to negative two or negative three percent. Even with artificial stimulus to demand you wouldn't see any excess demand. Even with a resumption in normal credit conditions you would have a lot of difficulty getting back to full employment."[10][11]

Robert J. Gordon wrote in August 2012: "Even if innovation were to continue into the future at the rate of the two decades before 2007, the U.S. faces six headwinds that are in the process of dragging long-term growth to half or less of the 1.9 percent annual rate experienced between 1860 and 2007. These include demography, education, inequality, globalization, energy/environment, and the overhang of consumer and government debt. A provocative 'exercise in subtraction' suggests that future growth in consumption per capita for the bottom 99 percent of the income distribution could fall below 0.5 percent per year for an extended period of decades".[12]

Post-2009

Secular stagnation was dusted off by Hans-Werner Sinn in a 2009 article [14] dismissing the threat of inflation, and became popular again when Larry Summers invoked the term and concept during a 2013 speech at the IMF.[15]

However, The Economist criticizes secular stagnation as "a baggy concept, arguably too capacious for its own good".[1] Warnings similar to secular stagnation theory have been issued after all deep recessions, but they all turned out to be wrong because they underestimated the potential of existing technologies.[3]

Paul Krugman, writing in 2014, clarified that it refers to "the claim that underlying changes in the economy, such as slowing growth in the working-age population, have made episodes like the past five years in Europe and the United States, and the last 20 years in Japan, likely to happen often. That is, we will often find ourselves facing persistent shortfalls of demand, which can’t be overcome even with near-zero interest rates."[16] At its root is "the problem of building consumer demand at a time when people are less motivated to spend".[17]

One theory is that the boost in growth by the internet and technological advancement in computers of the New economy does not measure up to the boost caused by the Great inventions of the past. An example of such a great invention is the assembly line production method of Fordism. The general form of the argument has been the subject of papers by Robert J. Gordon.[18] It has also been written about by Owen. C. Paepke and Tyler Cowen.[19]

Secular stagnation has also been linked to the rise of the digital economy. Carl Benedikt Frey, for example, has suggested that digital technologies are much less capital-absorbing, creating only little new investment demand relative to other revolutionary technologies.[20]

Another is that the damage done by the Great Recession was so long-lasting and permanent, so many workers will never get jobs again, that we really can't recover.[17]

A third is that there is a "persistent and disturbing reluctance of businesses to invest and consumers to spend", perhaps in part because so much of the recent gains have gone to the people at the top, and they tend to save more of their money than people—ordinary working people who can't afford to do that.[17]

A fourth is that advanced economies are just simply paying the price for years of inadequate investment in infrastructure and education, the basic ingredients of growth.[17]

And a fifth is that economic growth is largely related to the concept of energy returned on energy invested (EROEI), or energy surplus, which with the discovery of fossil fuels shot up to very high and historically unprecedented levels. This allowed, and in effect fueled, dramatic increases in human consumption since the Industrial Revolution and many related technological advances. Under this argument, diminishing and increasingly difficult to access fossil fuel reserves directly lead to significantly reduced EROEI, and therefore put a brake on, and potentially reverse, long-term economic growth, leading to secular stagnation.[21] Linked to the EROEI argument are those stemming from the Limits to Growth school of thinking, whereby environmental and resource constraints in general are likely to impose an eventual limit on the continued expansion of human consumption and incomes. While 'limits to growth' thinking went out of fashion in the decades following the initial publication in 1972, a recent study[22] shows human development continues to align well with the 'overshoot and collapse' projection outlined in the standard run of the original analysis, and this is before factoring in the potential effects of climate change.

See also

References

- 1 2 W., P. (16 August 2014). "Secular stagnation: Fad or fact?". The Economist.

- ↑

- 1 2 Pagano and Sbracia (2014) "The secular stagnation hypothesis: a review of the debate and some insights." Bank of Italy Questioni di Economia e Finanza occasional paper series number QEF-231.

- ↑ "Definition of secular stagnation". Financial Times. Retrieved 9 October 2014.

- ↑ Harris, Seymour E. (1943). Postwar Economic Problems (PDF). New York, London: McGraw Hill Book Co. pp. 67–82<Chapter IV Secular Stagnation by Alan Sweezy.>

- ↑ Magdoff, Harry; Sweezy, Paul (1987). Stagnation and the Financial Explosion. New York: Monthly Review Press.

- ↑ Lessons from Japan's Secular Stagnation The Research Institute of Economy, Trade and Industry

- ↑ Hoshi, Takeo; Kashyap, Anil K. (2004). "Japan's Financial Crisis and Economic Stagnation". Journal of Economic Perspectives. 18, No. 1 (Winter): 3–26.

- ↑ Paul Krugman-Bubbles, Regulation and Secular Stagnation-September 25, 2013

- ↑ Marco Nappollini- Pieria.com-Secular Stagnation and Post Scarcity-November 19, 2013

- ↑ Paul Krugman-Conscience of a Liberal Blog-Secular Stagnation, Coalmines, Bubbles, and Larry Summers-November 16, 2013

- ↑ Robert J. Gordon-Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds-August 2012

- ↑ Larry Summers-U.S. Economic Prospects-Keynote Address at the NABE Conference 2014

- ↑ Hans-Werner Sin, Forget Inflation, February 26, 2009

- ↑ "IMF Fourteenth Annual Research Conference in Honor of Stanley Fischer". 8 November 2013.

- ↑ Krugman, Paul (15 August 2014). "Secular Stagnation: The Book". New York Times.

- 1 2 3 4 Inskeep, Steve (9 September 2014). "Is The Economy Suffering From Secular Stagnation?". NPR.

- ↑ Gordon, Robert J. (2001). "Does the New Economy Measure Up to the Great Inventions of the Past? , Journal of Economic Perspectives, Vol. 4, No. 14 (Fall 2000) pp. 49-74".

- ↑ Paepke, C. Owen. The Evolution of Progress: The End of Economic Growth and the Beginning of Human Transformation. New York, Toronto: Random House. ISBN 0-679-41582-3.

- ↑ Frey, Carl Benedikt (2015). "The End of Economic Growth? How the Digital Economy Could Lead to Secular Stagnation , Scientific American, Vol. 312, No. 1".

- ↑ Morgan, Tim (2013). Life After Growth. Petersfield, UK: Harriman House. ISBN 9780857193391.

- ↑ Jackon, Tim; Webster, Robin (April 2016). Limits Revisited: A review of the limits to growth debate (PDF) (Report). London, UK: All-Party Parliamentary Group on Limits to Growth. Retrieved October 23, 2016.