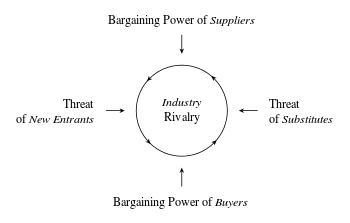

Porter's five forces analysis

Porter's five forces analysis is a framework that attempts to analyze the level of competition within an industry and business strategy development. It draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of an Industry. Attractiveness in this context refers to the overall industry profitability. An "unattractive" industry is one in which the combination of these five forces acts to drive down overall profitability. A very unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit. This analysis is associated with its principal innovator Michael E. Porter of Harvard University.

Porter referred to these forces as the micro environment, to contrast it with the more general term macro environment. They consist of those forces close to a company that affect its ability to serve its customers and make a profit. A change in any of the forces normally requires a business unit to re-assess the marketplace given the overall change in industry information. The overall industry attractiveness does not imply that every firm in the industry will return the same profitability. Firms are able to apply their core competencies, business model or network to achieve a profit above the industry average. A clear example of this is the airline industry. As an industry, profitability is low and yet individual companies, by applying unique business models, have been able to make a return in excess of the industry average.

Porter's five forces include – three forces from 'horizontal' competition: the threat of substitute products or services, the threat of established rivals, and the threat of new entrants; and two forces from 'vertical' competition: the bargaining power of suppliers and the bargaining power of customers.

Porter developed his five forces analysis in reaction to the then-popular SWOT analysis, which he found unrigorous and ad hoc.[1] Porter's five forces is based on the structure–conduct–performance paradigm in industrial organizational economics. It has been applied to a diverse range of problems, from helping businesses become more profitable to helping governments stabilize industries.[2] Other Porter strategic frameworks include the value chain and the generic strategies.

Five forces

| Strategy |

|---|

|

|

Major dimensions |

|

Major thinkers |

|

Frameworks and tools |

Threat of new entrants

Profitable markets that yield high returns will attract new firms. This results in many new entrants, which eventually will decrease profitability for all firms in the industry. Unless the entry of new firms can be blocked by incumbents (which in business refers to the largest company in a certain industry, for instance, in telecommunications, the traditional phone company, typically called the "incumbent operator"), the abnormal profit rate will trend towards zero (perfect competition).

The following factors can have an effect on how much of a threat new entrants may pose:

- The existence of barriers to entry (patents, rights, etc.). The most attractive segment is one in which entry barriers are high and exit barriers are low. Few new firms can enter and non-performing firms can exit easily.

- Government policy

- Capital requirements

- Absolute cost

- Cost disadvantages independent of size

- Economies of scale

- Economies of product differences

- Product differentiation

- Brand equity

- Switching costs or sunk costs

- Expected retaliation

- Access to distribution

- Customer loyalty to established brands

- Industry profitability (the more profitable the industry the more attractive it will be to new competitors)

- Network effect

Threat of substitutes

The existence of products outside of the realm of the common product boundaries increases the propensity of customers to switch to alternatives. For example, tap water might be considered a substitute for Coke, whereas Pepsi is a competitor's similar product. Increased marketing for drinking tap water might "shrink the pie" for both Coke and Pepsi, whereas increased Pepsi advertising would likely "grow the pie" (increase consumption of all soft drinks), albeit while giving Pepsi a larger slice at Coke's expense. Another example is the substitute of a landline phone with a cellular phone.

Potential factors:

- Buyer propensity to substitute

- Relative price performance of substitute

- Buyer switching costs

- Perceived level of product differentiation

- Number of substitute products available in the market

- Ease of substitution

- Substandard product

- Quality depreciation

- Availability of close substitute

Bargaining power of buyers

The bargaining power of customers is also described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer's sensitivity to price changes. Firms can take measures to reduce buyer power, such as implementing a loyalty program. The buyer power is high if the buyer has many alternatives. The buyer power is low if they act independently e.g. If a large number of customers will act with each other and ask to make prices low the company will have no other choice because of large number of customers pressure.

Potential factors:

- Buyer concentration to firm concentration ratio

- Degree of dependency upon existing channels of distribution

- Bargaining leverage, particularly in industries with high fixed costs

- Buyer switching costs relative to firm switching costs

- Buyer information availability

- Force down prices

- Availability of existing substitute products

- Buyer price sensitivity

- Differential advantage (uniqueness) of industry products

- RFM (customer value) Analysis

- The total amount of trading

Bargaining power of suppliers

The bargaining power of suppliers is also described as the market of inputs. Suppliers of raw materials, components, labor, and services (such as expertise) to the firm can be a source of power over the firm when there are few substitutes. If you are making biscuits and there is only one person who sells flour, you have no alternative but to buy it from them. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

Potential factors are:

- Supplier switching costs relative to firm switching costs

- Degree of differentiation of inputs

- Impact of inputs on cost or differentiation

- Presence of substitute inputs

- Strength of distribution channel

- Supplier concentration to firm concentration ratio

- Employee solidarity (e.g. labor unions)

- Supplier competition: the ability to forward vertically integrate and cut out the buyer.

Industry rivalry

For most industries the intensity of competitive rivalry is the major determinant of the competitiveness of the industry.

Potential factors:

- Sustainable competitive advantage through innovation

- Competition between online and offline companies

- Level of advertising expense

- Powerful competitive strategy

- Firm concentration ratio

- Degree of transparency

Usage

Strategy consultants occasionally use Porter's five forces framework when making a qualitative evaluation of a firm's strategic position. However, for most consultants, the framework is only a starting point or "checklist". They might use value chain or another type of analysis in conjunction.[3] Like all general frameworks, an analysis that uses it to the exclusion of specifics about a particular situation is considered naive.

According to Porter, the five forces model should be used at the line-of-business industry level; it is not designed to be used at the industry group or industry sector level. An industry is defined at a lower, more basic level: a market in which similar or closely related products and/or services are sold to buyers. (See industry information.) A firm that competes in a single industry should develop, at a minimum, one five forces analysis for its industry. Porter makes clear that for diversified companies, the first fundamental issue in corporate strategy is the selection of industries (lines of business) in which the company should compete; and each line of business should develop its own, industry-specific, five forces analysis. The average Global 1,000 company competes in approximately 52 industries (lines of business).

Criticisms

Porter's framework has been challenged by other academics and strategists such as Stewart Neill. Similarly, the likes of ABC, Kevin P. Coyne and Somu Subramaniam have stated that three dubious assumptions underlie the five forces:

- That buyers, competitors, and suppliers are unrelated and do not interact and collude.

- That the source of value is structural advantage (creating barriers to entry).

- That uncertainty is low, allowing participants in a market to plan for and respond to competitive behavior.[4]

An important extension to Porter was found in the work of Adam Brandenburger and Barry Nalebuff of Yale School of Management in the mid-1990s. Using game theory, they added the concept of complementors (also called "the 6th force"), helping to explain the reasoning behind strategic alliances. Complementors are known as the impact of related products and services already in the market.[5] The idea that complementors are the sixth force has often been credited to Andrew Grove, former CEO of Intel Corporation. According to most references, the sixth force is government or the public. Martyn Richard Jones, whilst consulting at Groupe Bull, developed an augmented 5 forces model in Scotland in 1993. It is based on Porter's model and includes Government (national and regional) as well as Pressure Groups as the notional 6th force. This model was the result of work carried out as part of Groupe Bull's Knowledge Asset Management Organisation initiative.

Porter indirectly rebutted the assertions of other forces, by referring to innovation, government, and complementary products and services as "factors" that affect the five forces.[6]

It is also perhaps not feasible to evaluate the attractiveness of an industry independent of the resources a firm brings to that industry. It is thus argued (Wernerfelt 1984)[7] that this theory be coupled with the Resource-Based View (RBV) in order for the firm to develop a much more sound strategy. It provides a simple perspective for accessing and analyzing the competitive strength and position of a corporation, business or organization.

See also

- Coopetition

- National Diamond

- Value chain

- Porter's four corners model

- Industry classification

- Nonmarket forces

- Economics of Strategy

References

- ↑ Michael Porter, Nicholas Argyres, Anita M. McGahan, "An Interview with Michael Porter", The Academy of Management Executive 16:2:44 at JSTOR

- ↑ Michael Simkovic, Competition and Crisis in Mortgage Securitization

- ↑ Tang, David (21 October 2014). "Introduction to Strategy Development and Strategy Execution". Flevy. Retrieved 2 November 2014.

- ↑ Kevin P. Coyne and Somu Subramaniam, Bringing discipline to strategy, The McKinsey Quarterly, 1996, Number 4, pp. 14-25

- ↑ Brandenburger, A. M., & Nalebuff, B. J. (1995). The right game: Use game theory to shape strategy. Harvard Business Review, 73(4), 57-71. PDF

- ↑ Michael E. Porter. "The Five Competitive Forces that Shape Strategy", Harvard Business Review, January 2008, p.86-104. PDF

- ↑ Wernerfelt, B. (1984), A resource-based view of the firm, Strategic Management Journal, Vol. 5, (April–June): pp. 171-180 PDF

Further reading

| Wikimedia Commons has media related to Porter's Five Forces Model. |

- Coyne, K.P. and Sujit Balakrishnan (1996),Bringing discipline to strategy, The McKinsey Quarterly, No.4.

- Porter, M.E. (March–April 1979) How Competitive Forces Shape Strategy, Harvard Business Review.

- Porter, M.E. (1980) Competitive Strategy, Free Press, New York.

- Porter, M.E. (January 2008) The Five Competitive Forces That Shape Strategy, Harvard Business Review.

- Ireland, R. D., Hoskisson, R., & Hitt, M. (2008). Understanding business strategy: Concepts and cases. Cengage Learning.

- Rainer R.K. and Turban E. (2009), Introduction to Information Systems (2nd edition), Wiley, pp 36–41.

- Kotler P. (1997), Marketing Management, Prentice-Hall, Inc.

- Mintzberg, H., Ahlstrand, B. and Lampel J. (1998) Strategy Safari, Simon & Schuster.