Negative gearing

Negative gearing is a practice whereby an investor borrows money to acquire an income-producing investment property and expects the gross income generated by the investment, at least in the short term, to be less than the cost of owning and managing the investment, including depreciation and interest charged on the loan (but excluding capital repayments). The arrangement is a form of financial leverage. The investor may enter into such an arrangement and expect the tax benefits (if any) and the capital gain on the investment, when the investment is ultimately disposed of, to exceed the accumulated losses of holding the investment.

Tax treatment of negative gearing would be a factor that the investor would take into account in entering into the arrangement, which may generate additional benefits to the investor in the form of tax benefits if the loss on a negatively geared investment is tax-deductible against the investor's other taxable income and if the capital gain on the sale is given a favourable tax treatment. Some countries, including Australia, Japan and New Zealand allow unrestricted use of negative gearing losses to offset income from other sources. Several other OECD countries, including the US, Germany, Sweden, and France, allow loss offsetting with some restrictions. In Canada, losses cannot be offset against wages or salaries. Applying tax deductions from negatively geared investment housing to other income is not permitted in the UK or the Netherlands.[1] With respect to investment decisions and market prices, other taxes such as stamp duties and capital gains tax may be more or less onerous in those countries, increasing or decreasing the attractiveness of residential property as an investment.[2]

Another example of is borrowing to purchase shares whose dividends fall short of interest costs. A common type of loan to finance such a transaction is called a margin loan. The tax treatment may or may not be the same.

Negative gearing is a form of leveraged investment. In a few countries, the strategy is motivated by taxation systems that permit deduction of losses against taxed income, and tax capital gains at a lower rate. When the income generated covers the interest, it is simply a geared investment, which creates passive income.

A negative gearing strategy makes a profit under any of the following circumstances:

- if the asset rises in value so that the capital gain is more than the sum of the ongoing losses over the life of the investment

- if the income stream rises to become greater than the cost of interest (the investment becomes positively geared)

- if the interest cost falls because of lower interest rates or paying down the principal of the loan (again, making the investment positively geared)

The investor must be able to fund any shortfall until the asset is sold or until the investment becomes positively geared (income > interest). The different tax treatment of planned ongoing losses and possible future capital gains affects the investor's final return and leads to a situation in countries that tax capital gains at a lower rate than income. In those countries,it is possible for an investor to make a loss overall before taxation but a small gain after taxpayer subsidies.

Deduction of negative gearing losses on property against income from other sources is permitted in several countries, including Canada, Australia and New Zealand. A negatively-geared investment property will generally remain negatively geared for several years, when the rental income will have increased with inflation to the point that the investment is positively geared (the rental income is greater than the interest cost).

Positive gearing occurs when one borrows to invest in an income-producing asset and the returns (income) from that asset exceed the cost of borrowing. From then on, the investor must pay tax on the rental income profit until the asset is sold, when point the investor must pay capital gains tax on any profit.

Australia

In Australia, negative gearing, defined in this case as a rental loss offset against other income, possesses a level of controversy which is lacking in other countries that allow this practice. In Australia, negative gearing by property investors reduced personal income tax revenue in Australia by $600 million in the 2001/02 tax year, $3.9 billion in 2004/05 and $13.2 billion in 2010/11.

Negative gearing was a hot-topic issue in the lead up to the 2016 federal election. Analysis had found that negative gearing in Australia provides a greater benefit to wealthier Australians than the less wealthy.[3] Federal Treasurer Scott Morrison, in defence of negative gearing, cited tax data that shows that numerous middle income groups (he cited teachers, nurses, and electricians) benefit in larger numbers from negative gearing than finance managers.[4] (The raw numbers don't show the extent to which different professional groups benefit).

In contrast, other countries that allow “rental loss offset against other income”:

- Restrict the practice to lower/middle income taxpayer who are active in managing their rental investment, as occurs in the United States.

- Limit the practice by ensuring the investment generated a positive return over its life, as occurs in Canada.

- Possess a more effective method to reduce tax by allowing any interest costs against the family home to be fully tax deductible, as occurs in the United States.

- Have a lower benefit due to a lower top rate of tax or a higher threshold for a specific tax rate, as is the case in most other countries which allow this practice.

More research into this area would be useful in attempting to understand why there is such a level of controversy in Australia.

History

Traditionally, taxpayers have been allowed to negatively-gear their investment properties. The only restrictions were dual prohibitions on the transfer of contingent property income and the transfer of income from labour.[5] In simple terms, losses from property being rented could not be transferred to an individual's income from labour, however it could be transferred to any other form of income. It is assumed this applied to losses as well as income, but this is unclear in the INCOME TAX ASSESSMENT ACT 1936.[6] As prior to 1985, Governments had allowed Courts to dictate many aspect of tax law, this information may be contained in a court ruling which I am unable to locate.

In 1983, the Victorian Deputy Commissioner of Taxation briefly denied Victorian real estate investors the deduction for interest in excess of the rental income, so losses could not be transferred nor moved to a future tax year. That ruling was quickly over-ruled by the federal tax commissioner (see Hanegbi, 2002).[7]

Following the tax summit in July 1985, the Hawke/Keating government disallowed negative gearing interest expenses on properties bought after 17 July 1985. It meant that taxpayers could offset only interest expenses against rental income. It was no longer possible to obtain a tax deduction for that part of the interest expense that exceeded the net income from properties (that is rent less other expenses such as rates, maintenance, etc.). The left over interest costs could not be offset against other income. However, it could be carried forward to offset property income in later years.

In addition a Capital gains tax (CGT) was introduced in Australia on 20 September 1985. While a separate tax, it is often associated with negative gearing.

In July 1987 the government reversed its decision and allowed negative gearing losses to be applied against income from labour.

What is uncertain is the situation between 1983 and July 1985, some sources indicated rental losses could be applied against income during this period, however prior to 1983 this was not the case. It should be pointed out a common method of bypassing this rule was to convert income from labour into another form of income, through the use of partnerships and other legal mechanisms. As a result, this restriction may not have been significant.

Taxation

Australian tax treatment of negative gearing is as follows:

- Interest on an investment loan for an income producing purpose is fully deductible if the income falls short of the interest payable. The shortfall can be deducted for tax purposes from income from other sources, such as the wage or salary income of the investor.

- Ongoing maintenance and small expenses are similarly fully deductible.

- Property fixtures and fittings are treated as plant, and a deduction for depreciation is allowed based on effective life. When they are later sold, the difference between actual proceeds and the written-down value becomes income or further deduction.

- Capital works (buildings or major additions, constructed after 1997 or certain other dates) attract a 2.5% per annum capital works deduction (or 4% in certain circumstances). The percentage is calculated on the initial cost (or an estimate thereof) and can be claimed until the cost of the works has been completely recovered. The investor's cost base for capital gains tax purposes is reduced by the amount claimed.

- On sale, or most other methods of transfer of ownership, capital gains tax is payable on the proceeds minus cost base (excluding items treated as plant above). A net capital gain is taxed as income, but if the asset was held for one year or more, the gain is first discounted by 50% for an individual, or a third for a superannuation fund. (The discount began in 1999, prior to which an indexing of costs and a stretching of marginal rates applied instead.)

The tax treatment of negative gearing and capital gains may benefit investors in a number of ways, including:

- Losses are deductible in the financial year they are incurred and provide nearly immediate benefit.

- Capital gains are taxed in the financial year when a transfer of ownership occurs (or other less common triggering event), which may be many years after the initial deductions.

- If it is held for more than twelve months, only 50% of the capital gain is taxable.[8]

- Transfer of ownership may be deliberately timed to occur in a year in which the investor is subject to a lower marginal tax rate, reducing the applicable capital gains tax rate compared to the tax rate saved by the initial deductions.

However, in certain situations the tax rate applied to the capital gain may be higher than the rate of tax saving because of initial deductions such as for investors who have a low marginal tax rate while they make deductions but a high marginal rate in the year the capital gain is realised.

In contrast, the tax treatment of real estate by owner-occupiers differs from investment properties. Mortgage interest and upkeep expenses on a private property are not deductible, but any capital gain (or loss) made on disposal of a primary residence is tax-free. (Special rules apply on a change from private use to renting or vice versa and for what is considered a main residence.)

Arguments for and against

The economic and social effects of negative gearing in Australia are a matter of ongoing debate. Those in favour of negative gearing argue:

- Negatively-geared investors support the private residential tenancy market, assisting those who cannot afford to buy, and reducing demand on government public housing.

- Investor demand for property supports the building industry, creating employment.

- Tax benefits encourage individuals to invest and save, especially to help them become self-sufficient in retirement.

- Startup losses are accepted as deductions for business and should also be accepted for investors since investors will be taxed on the result.

- Interest expenses deductible by the investor are income for the lender so there is no loss of tax revenue.

- Negatively-geared properties are running at an actual loss to the investor. Even though the loss may be used to reduce tax, the investor is still in a net worse position compared to not owning the property. The investor is expecting to make a profit either when the net rental income grows over time and exceeds the interest cost, and/or on the capital gain when the property is sold. After sale, the treatment of the capital gain income is favoured by the tax system since the only half of the capital gain is assessed as taxable income if the investment is held for at least 12 months (before 2000–2001, only the real value of the capital gain was taxed, which had a similar effect). From that perspective, distortions are generated by the 50% discount on capital gains income for income tax purposes, not negative gearing.

Opponents of negative gearing argue:

- It encourages over-investment in residential property, which is an economic distortion.

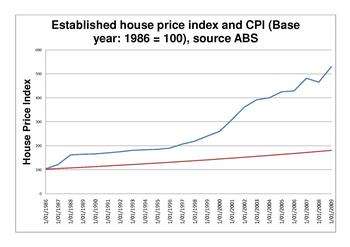

- Investors inflate the residential property market, making it less affordable for first home buyers or other owner-occupiers.

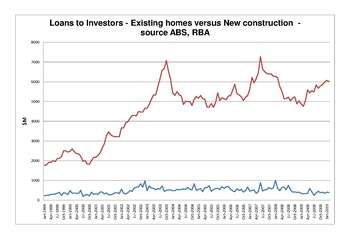

- In 2007, nine out of ten negatively geared properties in Australia were existing dwellings so the creation of rental supply comes almost entirely at the expense of displacing potential owner-occupiers. Thus, if negative gearing is to exist, it should be applied only to newly constructed properties.

- It encourages speculators into the property market, such as in the Australian property bubble that began in the mid-1990s, partly the result of increased availability of credit that occurred following the entry of non-bank lenders into the Australian mortgage market.

- Tax deductions and overall benefits accrue to those who already have high incomes, which will make the rich investors even richer and the poorer population even poorer, possibly creating and prolonging a social divide between socio-economic classes.

- Tax deductions reduce government revenue by a significant amount each year so non-investors subsidising investors and so the government is less able to provide other programs.

- Business expenses (including interest payments) should be deductible against current or future income from that business, not against other forms of current income. Even if the tax code did not allow negative gearing offsets, the cost of operating the rental property (including interest payments) will be deductible from future net rental income or will reduce the capital gains tax at the time of sale of the property.

Political history

In July 1985, the Hawke/Keating government quarantined negative gearing interest expenses on new transactions so that they could be claimed only against rental income, not other income. (Any excess could be carried forward for use in later years.) What is less appreciated is that Hawke/Keating had introduced negative gearing only six months earlier. Previous to their initial decision, the Income Tax Assessment Act 1936 had quarantined all property losses from deduction against income from personal exertion (other business or salary and wage income). Any losses incurred in any year would be accumulated on a register and be allowed only as a deduction from income from property in succeeding years. Property income and property losses were in one 'bucket', and personal exertion income and losses were in another 'bucket'.

That ensured that at personal level and, more importantly, at a national level, property losses would not be subsidised by income from personal exertion. In applying the formula, all previous governments thereby isolated and consequently discouraged capital speculation being subsidised from the general income tax receipts pool.

Keating initially changed the legislative treatment only months prior to attempting to revert to the original. Politically, those who took immediate benefit from the initial change made false claims that any attempt to remedy the situation would give rise to an explosive increase in rents. There was no statistical or real world data to support this claim other than localised increases in real rents in both Perth and Sydney, which also happened to have the lowest vacancy rates of all capital cities at the time.[9] That was enough to have Hawke/Keating submit to the landlords' demands and remove the attempt at repairing the initial decision.

That is what is described below as a dampening of 'investor enthusiasm', which is not quite the context, as the previous rules (which Keating had first removed and then quickly attempted to reinstate) had been in place since 1936. The argument that somehow investor enthusiasm had been dampened is a shallow argument, as negative gearing had never existed during the Act's existence and had only a very short life and only after Keating's initial amendments to the previous longstanding practice.

After intense lobbying by the property industry, which claimed that the changes to negative gearing had caused investment in rental accommodation to dry up and rents to rise, the government again amended the Act to include Keating's changes to the previous legislation and once again permitted deducting interest and other rental property costs from other income sources.

Alternative view

The view that the temporary removal of negative gearing caused rents to rise has been challenged by Saul Eslake, who has been quoted as saying, "It's true, according to Real Estate Institute data, that rents went up in Sydney and Perth. But the same data doesn't show any discernible increase in the other state capitals. I would say that, if negative gearing had been responsible for a surge in rents, then you should have observed it everywhere, not just two capitals. In fact, if you dig into other parts of the REI database, what you find is that vacancy rates were unusually low at that time before negative gearing was abolished." [10]

While Eslake's comment is correct for inflation-adjusted rents (when CPI inflation is subtracted from the nominal rent increases), nominal rents nationally rose by over 25% during the two years that negative gearing was quarantined. Nominal rents rose strongly in every Australian capital city, according to the official ABS CPI data. However, it has not been proved that the strong rise in rents was entirely a direct result of the quarantine.[11]

Also, as negative gearing had not previously existed at all prior to Keating's initial amendment to the Act, it is a very difficult argument to say that its brief absence in the period of indecision had any effect on property values. There had never been such thing as negative gearing, as all property losses had always been quarantined from deduction against income from personal exertion and could deducted only against future profits/income from property sources.

With some irony, it is a return to the quarantine of losses that comprised arguments in dealing with property losses and the removal of negative gearing.

Commentary from Eslake and others has highlighted the preponderance of negatively-geared purchases in established suburbs where the probability of a lightly-taxed capital gain exists, thus debunking the myth that negative gearing leads to new construction. Many economists [12] have commented extensively on the tax subsidy being made available to speculative buyers in competition against homebuyers, who have no such tax subsidy, leading to significant social dislocation.

What is not broadly realised is that the tax subsidy feeding into higher home prices adds to the wealth of those taking advantage of negative gearing. The process that crowds out domestic home owners by pushing up the price of housing also automatically makes the successful user of negative gearing more asset rich via the increase in land value, which perversely then allows the same people to borrow even more funds against equity in the previously acquired properties resulting in even more acquisitions under tax subsidy, which further exacerbate the problems for those seeking to become owner-occupiers.

That clearly leads to heavy economic and social dislocation and creates a property bubble to which the banks are clearly vulnerable, which represents both a danger to future economic stability and, by the introduction of powerful vested interests (the banks) to this speculative equation, a potential limitation of financial and budgetary settings that recent overseas experience show blight the lives of many to favour the few.

Effect on housing affordability

In 2003, the Reserve Bank of Australia (RBA) stated in its submission to the Productivity Commission First Home Ownership Inquiry that "there are no specific aspects of current tax arrangements designed to encourage investment in property relative to other investments in the Australian tax system.... the most sensible area to look for moderation of demand is among investors.... the taxation treatment in Australia is more favourable to investors than is the case in other countries.

"In particular, the following areas appear worthy of further study by the Productivity Commission: "1. ability to negatively gear an investment property when there is little prospect of the property being cash-flow positive for many years; "2. benefit investors receive when property depreciation allowances are 'clawed back' through the capital gains tax; "3. general treatment of property depreciation, including the ability to claim depreciation on loss-making investments."[13]

In 2008, the Senate Housing Affordability report echoed the findings of the 2004 Productivity Commission report. One recommendation to the enquiry suggested that negative gearing should be capped: "There should not be unlimited access. Millionaires and billionaires should not be able to access it, and you should not be able to access it on your 20th investment property. There should be limits to it."[14]

While negative Gearing has an influence on housing affordability, the primary issue is a mis-match between supply and demand.[15]

…demand for housing has increased significantly over the last 30 years, the supply of new dwellings has not responded, with average annual completions of new dwellings remaining around 150,000 since the mid-1980s.

The effect of negative gearing on the supply side of dwelling construction is difficult to pin down.

United Kingdom

While allowing for Negative Gearing in its basic form, the United Kingdom does not allow the transfer of one type of income (or loss) to another type of income. This is due to its Schedular system of taxation. In this type of taxation system the tax paid is dependent on income source, as a result an individual who received an income from labour and from land would pay two separate tax rates for the two relevant income sources.

Between 1997 and 2007 the Tax Law Rewrite Project changed this system by simplifying the schedules. As with the previous system they would not be allowed to transfer incomes (or losses).

The Renting out your property (England and Wales) Site [16] outlines how to offset any losses.

You can offset your loss against:

- future profits by carrying it forward to a later year

- profits from other properties (if you have them)

New Zealand

New Zealand allow Negative Gearing and the transfer of losses to other income streams, with some restrictions.[17]

The Rental Income Guide [18] states a loss can only be deducted against other incomes if the rental income is at market rate.

The Opposition Labor Party attempted to raise Negative Gearing in the 2011 election, but after their failure to win government this issue has reduced in significance.[19]

Canada

In principal Canada does not allow the transfer of income streams, however the following excerpt from the most current Canadian Tax form indicates this can occur in some circumstances.[20]

According to Line 221 - Carrying charges and interest expenses [21] interest payments from an investment designed to generate an income can be deducted.

Deductions : Most interest you pay on money you borrow for investment purposes, but generally only if you use it to try to earn investment income, including interest and dividends. However, if the only earnings your investment can produce are capital gains, you cannot claim the interest you paid.

Other sources indicate the deduction must be reasonable and you should contact the CRA for more information. The "Rental Income Includes Form T776"[22] clearly states you can deduce Rental Loses from other sources of income.

Rental losses : You have a rental loss if your rental expenses are more than your gross rental income. If you incur the expenses to earn income, you can deduct your rental loss against your other sources of income.

However, there is a caveat, the rental loss must be reasonable. What is reasonable is not defined in the "Rental Income Includes Form T776" Guide.

Based on these sources claiming rental losses against other incomes in a given year is allowed as long as over the life of the investment a profit is made, excluding the effects of capital gains.

It should be noted that Canada has a Federal and Provincial income tax, the above only relates to Federal income tax.

United States

In principal the USA Federal tax does not allow the transfer of income streams.[23] In general, you can only deduct expenses of renting property from your rental income, however there are exceptions to this restriction.

It is possible deduct any loss against other incomes, depending on a range of factors.[24]

Definition of "Active participation." is outlined in the "Reporting Rental Income, Expenses, and Losses" guide.[25]

You actively participated in a rental real estate activity if you (and your spouse) owned at least 10% of the rental property and you made management decisions or arranged for others to provide services (such as repairs) in a significant and bona fide sense. Management decisions that may count as active participation include approving new tenants, deciding on rental terms, approving expenditures, and other similar decisions.

Japan

Japan allows tax payers to offset rental losses against other income.[26]

Individuals can claim losses against Rental Loss with minimal restrictions,[27] but if the Property was owned through a Partnership or Trust there are restrictions.[28]

There are a number of additional rules, such as restricting claims of losses due to Bad Debt. Additional information can be found in the Japan tax Site.[29]

Germany

The German Tax system is complex, but within the bounds of standard Federal Income tax, Germany does not allow the transfer of income. Rental Losses can only be offset against Rental income.[30]

Owners can deduct any expenses from the gross receipts, which were incurred to produce, maintain and safeguard that income.

Germany recognizes seven sources of income, the income is calculated separately:[31]

- Agriculture and forestry

- Trade and business

- Independent personal services

- Employment

- Capital investment

- Rents and royalties

- "other income", as specified and strictly limited by law to certain types of income such as income from private transactions and income of a recurring nature (e.g. pensions)

Rental income is taxed as income and is subject to the progressive tax rate. Interest on loans provided to finance real estate, expenses and property related cost (e.g. management fees, insurance, etc.) can be deducted from the taxable rental income.[32]

Netherlands

In principal the Dutch tax system does not allow the transfer of income. Most citizens calculate tax, separately, in 3 income groups.[33]

- Box 1 income includes income from employment and income from the primary residence.

- Box 2 income, which includes income from a substantial holding in a company, as well as gains from substantial shareholdings

- Box 3 deals with income from savings and investments

However, there is no clear definition where Rental income fits in these categories. Dutch resident and non-resident companies and partnerships owning Dutch property are in principle allowed to deduct interest expenses on loans from banks or affiliated companies, and property-related costs from their taxable income.[34]

As with many countries, the practice of offsetting rental losses against income tax is possible, in certain situations. (Needs more research)

See also

- Taxation in Australia

- Taxation in Canada

- Debt

- Financial engineering

- Investment

- Leveraged buyout

- Margin (finance)

- Return on margin

- Rent seeking

- Speculation

References

- ↑ "Quarantining Interest Deductions for Negatively Geared Rental Property Investments" [2005]

- ↑ Housing and Housing Finance: The View from Australia and Beyond, RBA [2006]

- ↑ http://m.smh.com.au/federal-politics/political-news/negative-gearing-benefits-the-rich-far-more-than-everyday-australians-analysis-shows-20151113-gkyllz.html

- ↑

- ↑ Avoidance, Evasion and Reform: Who Dismantled and who's rebuilding the Australian Income Tax System

- ↑ INCOME TAX ASSESSMENT ACT 1936

- ↑ Negative Gearing: Future Directions

- ↑ Lim, Esther. "CGT exemptions, rollovers and concessions". Australian Taxation Office. Australian Government. Retrieved 28 February 2016.

- ↑ http://www.abc.net.au/news/2015-05-06/hockey-negative-gearing/6431100

- ↑ http://www.abc.net.au/lateline/content/2003/s991144.htm

- ↑ http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6401.0Mar%202013

- ↑ "Negative Gearing Facts title". Retrieved 10 March 2012.

- ↑ RBA Submission to Productivity Commission Inquiry - First Home Ownership

- ↑ 2008 Senate Housing Affordability report Chapter 4.57

- ↑ Senate Affordable Housing Report - Parliament of Australia

- ↑ Renting out your property (England and Wales)

- ↑ Harcourts - “Negative Gearing” Explained

- ↑ IRD - Rental income IR264

- ↑ NZ moves to quarantine negative gearing

- ↑ Investopedia - Negative Gearing

- ↑ CRA Line 221 - Carrying charges and interest expenses

- ↑ CRA - Rental Income Guide

- ↑ IRS Topic 414 - Rental Income and Expenses

- ↑ Rental Income and Expenses - Tips for Schedule E

- ↑ IRS Reporting Rental Income, Expenses, and Losses

- ↑ Authorities challenge real estate loss deduction

- ↑ Analysis of Income (use for real estable income)

- ↑ The Japanese taxation of real estate income for individuals

- ↑ The Japan tax Site

- ↑ Rental income tax is high in Germany

- ↑ The German tax System

- ↑ German Tax Overview

- ↑ Taxation and Investment in Netherlands 2015

- ↑ Real Estate Going Global Netherlands

External links

- Negative Gearing Issue Sheet for the Australian federal election, 2004

- Australian Taxation Office Rental Properties Guide 2005, product NAT 1729-6.2005

- Real Estate Institute of Australia Policy Statement on Negative Gearing, as of October 2005

- Negative Gearing—A Commentary on how it works and who it is suited to

- Negative Gearing — A Brief Overview of Negative Gearing In Australia and why people choose to do it: (Accountants, Caringbah Sydney, Australia)

- Australian Democrats Negative Gearing Issue Sheet for the 2004 Election (PDF)

- Australian Taxation Office Rental Properties Guide 2005, product NAT 1729-6.2005

- Real Estate Institute of Australia Policy Statement on Negative Gearing, as of October 2005

- Negative gearing: The three facts that will challenge your assumptions, Property Observer, 2013