Mount Union Area School District

| Mount Union Area School District | |

|---|---|

| Address | |

|

28 West Market Street Mount Union, Pennsylvania 17066 United States | |

| Information | |

| Type | Public |

| Superintendent | Dr. Brett Gilliland |

| Grades | K-12 |

| Color(s) | Royal Blue and Vegas Gold |

| Athletics conference | PIAA District 6 - Inter County Conference |

| Mascot | Trojans |

| Website | http://www.muasd.org/ |

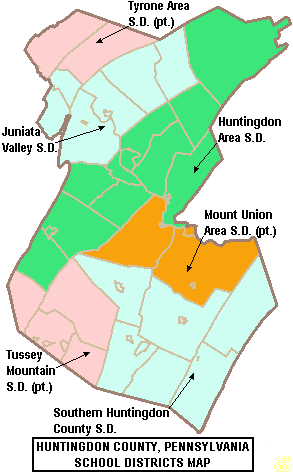

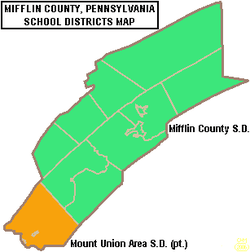

The Mount Union Area School District is a public school district based in Mount Union, Pennsylvania. The district encompasses approximately 151 square miles. According to 2000 federal census data, it serves a resident population of 9,678. The school district includes all of Mount Union borough, Mapleton borough, Shirley Township and Union Township in Huntingdon County. The school district also includes Kistler borough, Newton Hamilton borough, and Wayne Township, all located in Mifflin County. According to District officials, in school year 2005-06 the MUASD provided basic educational services to 1,516 pupils through the employment of 132 teachers, 73 full-time and part-time support personnel, and 10 administrators.

Schools

- Mount Union Area Senior High School - (Grades 9-12)

706 N. Shaver Street

Mount Union, Pennsylvania 17066 - Mount Union Area Junior High School - (Grades 7-8)

Pine Street

Mount Union, Pennsylvania 17066

There are three elementary schools in the district (all K-6)

- Kistler Elementary School Report Card 2010

154 School Street

Mount Union, Pennsylvania 17066 - Shirley Township Elementary School Report Card

14188 2nd Street

Mount Union, Pennsylvania 17066 - Mapleton-Union Elementary School Report Card 2010

13606 Smith Valley Road

Mapleton Pennsylvania 17052

Academic achievement

The Mount Union Area School District was ranked 457th out of 498 Pennsylvania school districts, in 2010, by the Pittsburgh Business Times. The ranking was based on student academic performance on four years of PSSA results in: reading, writing, mathematics and two years of science.[1]

- 2009 - 456th

- 2008 - 460th

- 2007 - 472nd of 501 school districts by the Pittsburgh Business Times.[2]

In 2009, the academic achievement, of the students in the Mount Union Area School District, was in the 14th percentile among all 500 Pennsylvania school districts Scale (0-99; 100 is state best) [3]

Graduation rate

Senior high school

The high school is in School Improvement II AYP status due to chronic, low student achievement in 2010.[7][8]

- PSSA Results

- 11th Grade Reading

- 2010 - 55% on grade level. In Pennsylvania, 66% of 11th graders on grade level.[9]

- 2009 - 46%, State - 65% [10]

- 2008 - 52%, State - 65%[11]

- 2007 - 53%, State - 65% [12]

- 11th Grade Math

- 2010 - 49% on grade level. In Pennsylvania, 59% of 11th graders are on grade level.

- 2009 - 49%, State - 56%

- 2008 - 47%, State - 56% [13]

- 2007 - 42%, State - 53%

- 11th Grade Science

- 2010 - 24% on grade level. State - 39% of 11th graders were on grade level.

- 2009 - 19%, State - 40%

- 2008 - 20%, State - 39%

- College remediation

According to a Pennsylvania Department of Education study released in January 2009, 14% of Mount Union Area Senior High School graduates required remediation in mathematics and or reading before they were prepared to take college level courses in the Pennsylvania State System of Higher Education or community colleges.[14] Less than 66% of Pennsylvania high school graduates, who enroll in a four-year college in Pennsylvania, will earn a bachelor's degree within six years. Among Pennsylvania high school graduates pursuing an associate degree, only one in three graduate in three years.[15] Per the Pennsylvania Department of Education, one in three recent high school graduates who attend Pennsylvania's public universities and community colleges takes at least one remedial course in math, reading or English.

Dual enrollment

The senior high school offers the Pennsylvania dual enrollment program. This state program permits high school students to take courses, at local higher education institutions, to earn college credits. Students remain enrolled at their high school. The courses count towards high school graduation requirements and towards earning a college degree. The students continue to have full access to activities and programs at their high school. The college credits are offered at a deeply discounted rate. The state offers a small grant to assist students in costs for tuition, fees and books.[16] Under the Pennsylvania Transfer and Articulation Agreement, many Pennsylvania colleges and universities accept these credits for students who transfer to their institutions.[17] The Pennsylvania College Credit Transfer System reported in 2009, that students saved nearly $35.4 million by having their transferred credits count towards a degree under the new system.[18]

In 2010 the district received $3,903 in a state grant to be used assist students with tuition, fees and books.

Graduation requirements

The Mount Union Area School Board has determined that, in order to graduate, a student must earn 25 credits, including: English 4 credits, Math 3 credits, Science 3 credits, Social Studies 3 credits, Humanities 2 credits, Health and Physical Education 1.60 credits and Electives & Graduation Project 8.40 credits. Additionally, students must demonstrate proficiency on the PSSAs or pass remediation courses.[19] If a student successfully completes course work at the Career and Technology Center in 9th, 10th, 11th, and 12th grades he/she will attain 3 credits per successful grade which supplant elective credits.[20]

By law, all Pennsylvania secondary school students must complete a project as a part of their eligibility to graduate from high school. The type of project, its rigor and its expectations are set by the individual school district.[21]

By Pennsylvania School Board regulations, for the graduating classes of 2015 and 2016, students must demonstrate successful completion of secondary level course work in Algebra I, Biology, English Composition, and Literature for which the Keystone Exams serve as the final course exams. Students’ Keystone Exam scores shall count for at least one-third of the final course grade.[22]

Junior high school

The school is in Warning status AYP status due to chronic low student achievement in 2010.

- 8th Grade Reading

- 2010 - 68% on grade level. State - 81% [23]

- 2009 - 66%, State - 80%

- 2008 - 65%, State - 78%

- 2007 - 62%, State - 75%[24]

- 8th Grade Math

- 2010 - 75% on grade level. State - 75%

- 2009 - 66%, State - 71%

- 2008 - 58%, State - 70% [25]

- 2007 - 68%, State - 67%

- 8th Grade Science

- 7th Grade Reading

- 2010 - 64% on grade level. State - 73%

- 2009 - 65%, State - 71.7%

- 2008 - 61%, State - 70%

- 2007 - 55%, State - 66%

- 7th Grade Math

- 2010 - 79% on grade level. State - 77%

- 2009 - 76%, State - 75%

- 2008 - 66%, State - 72%

- 2007 - 55%, State - 67%

Special education

In December 2009, the district administration reported that 287 pupils or 19% of the district's pupils received Special Education services.[28]

The District engages in identification procedures to ensure that eligible students receive an appropriate educational program consisting of special education and related services, individualized to meet student needs. At no cost to the parents, these services are provided in compliance with state and federal law; and are reasonably calculated to yield meaningful educational benefit and student progress. To identify students who may be eligible for special education, various screening activities are conducted on an ongoing basis. These screening activities include: review of group-based data (cumulative records, enrollment records, health records, report cards, ability and achievement test scores); hearing, vision, motor, and speech/language screening; and review by the Instructional Support Team or Student Assistance Team. When screening results suggest that the student may be eligible, the District seeks parental consent to conduct a multidisciplinary evaluation. Parents who suspect their child is eligible may verbally request a multidisciplinary evaluation from a professional employee of the District or contact the Supervisor of Special Education.[29]

In 2010, the state of Pennsylvania provided $1,026,815,000 for special education services. The funds were distributed to districts based on a state policy which estimates that 16% of the district's pupils are receiving special education services. This funding is in addition to the state's basic education per pupil funding, as well as, all other state and federal funding.[30]

Mount Union Area School District received a $902,644 supplement for special education services in 2010.[31]

Gifted education

The District Administration reported that 17 or 1.13% of its students were gifted in 2009.[32] By law, the district must provide mentally gifted programs at all grade levels. The primary emphasis is on enrichment and acceleration of the regular education curriculum through a push in model with the gifted instructor in the classroom with the regular instructor. The referral process for a gifted evaluation can be initiated by teachers or parents by contacting the student’s building principal and requesting an evaluation. All requests must be made in writing. To be eligible for mentally gifted programs in Pennsylvania, a student must have a cognitive ability of at least 130 as measured on a standardized ability test by a certified school psychologist. Other factors that indicate giftedness will also be considered for eligibility.[33]

Bullying policy

The Mount Union Area School District administration reported there were 2 incidents of bullying in the district in 2009.[34][35]

The Mount Union Area School Board adopted the district's antibully policy.[36] All Pennsylvania schools are required to have an anti-bullying policy incorporated into their Code of Student Conduct. The policy must identify disciplinary actions for bullying and designate a school staff person to receive complaints of bullying. The policy must be available on the school's website and posted in every classroom. All Pennsylvania public schools must provide a copy of its anti-bullying policy to the Office for Safe Schools every year, and shall review their policy every three years. Additionally, the district must conduct an annual review of that policy with students.[37] The Center for Schools and Communities works in partnership with the Pennsylvania Commission on Crime & Delinquency and the Pennsylvania Department of Education to assist schools and communities as they research, select and implement bullying prevention programs and initiatives.[38]

Education standards relating to student safety and antiharassment programs are described in the 10.3. Safety and Injury Prevention in the Pennsylvania Academic Standards for Health, Safety and Physical Education.[39]

Budget

In 2009, the district reports employing over 150 teachers with a starting salary of $30,675 for 180 days work.[40] The average teacher salary was $47,691 while the maximum salary is $105,575.[41] In Pennsylvania, the average teacher salary for Pennsylvania's 124,100 public school teachers was $54,977 in 2008.[42] As of 2007, Pennsylvania ranked in the top 10 states in average teacher salaries. When adjusted for cost of living Pennsylvania ranked fourth in the nation for teacher compensation.[43] Additionally, Mount Union Area School District teachers receive a defined benefit pension, health insurance which is paid by district in retirement until age 65, an up to $10,000 retirement bonus, professional development reimbursement, compensation for voluntary extracurricular activities, additional payment to write IEP plans for students, 3 paid personal days, and 10 sick days, life insurance and other benefits.[44] According to State Rep. Glen Grell, a trustee of the Pennsylvania Public School Employees’ Retirement System Board, a 40-year educator can retire with a pension equal to 100 percent of their final salary.[45]

In 2007, the district employed 123 teachers. The average teacher salary in the district was $42,902 for 180 school days worked.[46]

Mount Union Area School District administrative costs per pupil in 2008 was $720.81 per pupil. The district is ranked 289th out of 500 in Pennsylvania for administrative spending. The lowest administrative cost per pupil in Pennsylvania was $398 per pupil.[47]

In 2008, Mount Union Area School District reported spending $11,658 per pupil. This ranked 321st in the commonwealth.[48]

- Reserves

In 2009, the district reported a $3,177, 562in a unreserved-undesignated fund balance. The designated fund balance was reported as zero.[49] The Pennsylvania General Assembly sets a limit on how much money a district can have in its fund balance. The limit is based on the amount of the district's budget. As the total spending in the budget rises, the district is permitted to hold greater amounts in reserve.[50]

In August 2009, the Pennsylvania Auditor General conducted a performance audit of the district. Findings were reported to the administration and school board.[51]

The district is funded by a combination of: a local income tax, a property tax, a real estate transfer tax, coupled with substantial funding from the Commonwealth of Pennsylvania and the federal government. Grants can provide an opportunity to supplement school funding without raising local taxes. In the Commonwealth of Pennsylvania, pension and Social Security income are exempted from state personal income tax and local earned income tax regardless of the individual's wealth.[52]

State basic education funding

For 2010-11 the Mount Union Area School District received a 5.20% increase in state Basic Education Funding resulting in a $9,042,407 payment.[53] Huntingdon Area School District received a 5.49% increase which was the highest increase, in BEF, in Huntingdon County. Kennett Consolidated School District in Chester County received the highest increase in the state at 23.65% increase in funding for the 2010-11 school year. One hundred fifty school districts received the base 2% increase in 2010-11. The amount of increase each school district receives is determined by the Governor and the Secretary of Education through the allocation set in the state budget proposal made in February each year.[54]

In the 2009-2010 budget year the Commonwealth of Pennsylvania provided a 3.79% increase in Basic Education funding for a total of $8,595,494. The state Basic Education funding to the district in 2008-09 was $8,281,537.60. The district also received supplemental funding for English language learners, Title 1 federal funding for low-income students, for district size, a poverty supplement from the commonwealth and more.[55] Ninety school district received the base 2% increase. Huntingdon Area School District received the highest increase in Huntingdon County for the 2009-10 school year at 5.59%. Among the 500 school districts in Pennsylvania, Muhlenberg School District in Berks County received the highest with a 22.31% increase in funding.[56]

According to the Pennsylvania Department of Education, 758 district students received free or reduced-price lunches due to low family income in the 2007-2008 school year.[57]

Accountability Block Grants

Beginning in 2004-2005, the state launched the Accountability Block Grant school funding. This program has provided $1.5 billion to Pennsylvania’s school districts. The Accountability Block Grant program requires that its taxpayer dollars are focused on specific interventions that are most likely to increase student academic achievement. These interventions include: teacher training, all-day kindergarten, lower class size K-3rd grade, literacy and math coaching programs that provide teachers with individualized job-embedded professional development to improve their instruction, before or after school tutoring assistance to struggling students. For 2010-11 the Mount Union Area School District applied for and received $359,692 in addition to all other state and federal funding. The district used the funding to provide prekindergarten and full-day kindergarten, lower class size K-3rd grade and science instruction.[58][59]

School Improvement Grant

Mount Union Area Senior High School received a $2,546,600, three year federal/state grant for a Transformation reform program in 2010.[60] According to the grant information, the Transformation model includes the use of rigorous, transparent, and equitable evaluation systems for teachers and principals, high-quality professional development and design and development of curriculum with teacher and principal involvement. The grant is to implement specific, aggressive reforms designed to substantially improve student performance in schools that have a high percentage of students performing below grade level, and where insufficient progress has been made over the past 5 years.

Schools eligible for School Improvement Grants included the lowest-performing Title I schools whose Adequate Yearly Progress status is School Improvement or Corrective Action, and Title I-eligible schools that are the lowest-achieving and have not made satisfactory progress on state assessments. Title I-eligible schools are those that have a high percentage of economically disadvantaged students.[61]

Mount Union Kistler Elementary School was mandated to develop and implement a Continuous School Improvement Plan in 2009.[62]

Classrooms for the Future grant

The Classroom for the Future state program provided districts with hundreds of thousands of extra state funding to buy laptop computers for each core curriculum high school class (English, Science, History, Math) and paid for teacher training to optimize the computers use. The program was funded from 2006-2009. Mount Union Area School District did not apply for funding in 2006-07 nor in 2007-08. For the 2008-09, school year the district received $78,140. Of the 501 public school districts in Pennsylvania, 447 of them received Classrooms for the Future grant awards.[63]

Federal Stimulus grant

The district received an extra $1,415,128 in ARRA - Federal Stimulus money to be used in specific programs like special education and meeting the academic needs of low-income students.[64] The funding is for the 2009-10 and 2010-11 school years.

Race to the Top grant

School district officials applied for the Race to the Top federal grant which would have brought the district over one million additional federal dollars for improving student academic achievement.[65] The district has been identified as a low achievement turnaround district, so they would have also received an extra $750 per pupil in federal funding, in addition to the base grant. Participation required the administration, the school board and the local teachers' union to sign an agreement to prioritize improving student academic success. In Pennsylvania, 120 public school districts and 56 charter schools agreed to participate.[66] Pennsylvania was not approved for the grant. The failure of districts to agree to participate was cited as one reason that Pennsylvania was not approved.[67]

Common Cents state initiative

The Mount Union Area School Board did not participate in the Pennsylvania Department of Education Common Cents program. The program called for the state to audit the district, at no cost to local taxpayers, to identify ways the district could save tax dollars.[68] After the review of the information, the district was not required to implement the recommended cost savings changes.

Real estate taxes

The school board set property tax rates in 2010-2011 at 68.9200 mills in Huntingdon County. For Mifflin County - 22.57 mills.[69] A mill is $1 of tax for every $1,000 of a property's assessed value. Irregular property reassessments have become a serious issue in the commonwealth as it creates a significant disparity in taxation within a community and across a region. Pennsylvania school district revenues are dominated by two main sources: 1) Property tax collections, which account for the vast majority (between 75-85%) of local revenues; and 2) Act 511 tax collections (Local Tax Enabling Act), which are around 15% of revenues for school districts.[70] The school district includes municipalities in two counties, each of which has different rates of property tax assessment, necessitating a state board equalization of the tax rates between the counties.

- 2009-10 - 65.8900 mills for Huntingdon County and Mifflin County - 21.6900 mills.[71]

- 2008-09 - 59.6500 mills for Huntingdon County and Mifflin County - 20.4400.[72]

Act 1 Adjusted index

The Act 1 of 2006 Index regulates the rates at which each school district can raise property taxes in Pennsylvania. Districts are not authorized to raise taxes above that index unless they allow voters to vote by referendum, or they seek an exception from the state Department of Education. The base index for the 2011-2012 school year is 1.4 percent, but the Act 1 Index can be adjusted higher, depending on a number of factors, such as property values and the personal income of district residents. Act 1 included 10 exceptions, including: increasing pension costs, increases in special education costs, a catastrophe like a fire or flood, increase in health insurance costs for contracts in effect in 2006 or dwindling tax bases. The base index is the average of the percentage increase in the statewide average weekly wage, as determined by the PA Department of Labor and Industry, for the preceding calendar year and the percentage increase in the Employment Cost Index for Elementary and Secondary Schools, as determined by the Bureau of Labor Statistics in the U.S. Department of Labor, for the previous 12-month period ending June 30. For a school district with a market value/personal income aid ratio (MV/PI AR) greater than 0.4000, its index equals the base index multiplied by the sum of .75 and its MV/PI AR for the current year.[73]

The School District Adjusted Index for the Mount Union Area School District 2006-2007 through 2010-2011.[74]

- 2006-07 - 5.8%, Base 3.9%

- 2007-08 - 5.0%, Base 3.4%

- 2008-09 - 6.6%, Base 4.4%

- 2009-10 - 6.1%, Base 4.1%

- 2010-11 - 4.4%, Base 2.9%

- 2011-12 - 2.1%, Base 1.4%

The Mount Union Area School Board did not apply for exceptions to exceed the Act 1 index for the budgets in 2009-10 and 2010-11.[75] In the Spring of 2010, 135 Pennsylvania school boards asked to exceed their adjusted index. Approval was granted to 133 of them and 128 sought an exception for pension costs increases.[76]

In 2009-10 the school board applied for several exemptions, including Maintenance of Local Tax revenue and Maintenance of Selected Revenue Sources. In Pennsylvania, 25 school districts applied for the Maintenance of Local Tax revenue exemption while 24 school districts applied for Maintenance of Selected Revenue Sources.[77]

Property tax relief

In 2009, the Homestead/Farmstead Property Tax Relief from gambling for the Mount Union Area School District was $89 per approved permanent primary residence. In the district, 2,671 property owners applied for the tax relief. This was the lowest property tax relief allotted in Huntingdon County for 2009.[78] The tax relief was subtracted from the total annual school property on the individual's tax bill. Property owners apply for the relief through the county Treasurer's office. Farmers can qualify for a farmstead exemption on building used for agricultural purposes. The farm must be at least 10 contiguous acres and must be the primary residence of the owner. Farmers can qualify for both the homestead exemption and the farmstead exemption. According to a report by the Pennsylvania Auditor General 64.95% of homeowners in Huntingdon County had applied for the tax relief.[79] Pennsylvania awarded the highest property tax relief to residents of the Chester-Upland School District in Delaware County at $632 per homestead and farmstead in 2010.[80] This was the second year they were the top recipient.

Additionally, the Pennsylvania Property Tax/Rent Rebate program is provided for low income Pennsylvanians aged 65 and older; widows and widowers aged 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 for homeowners. The maximum rebate for both homeowners and renters is $650. Applicants can exclude one-half (1/2) of their Social Security income, consequently individuals who have income substantially more than $35,000, may still qualify for a rebate. Individuals must apply annually for the rebate. This can be taken in addition to Homestead/Farmstead Property Tax Relief.[81]

Property taxes in Pennsylvania are relatively high on a national scale. According to the Tax Foundation, Pennsylvania ranked 11th in the U.S. in 2008 in terms of property taxes paid as a percentage of home value (1.34%) and 12th in the country in terms of property taxes as a percentage of income (3.55%).[82]

Career & Technology Centers

High school students can attend Huntingdon County Career & Technology Center - Mill Creek - Grades 10-12

High School Alma Mater

Now we all march together

On through fair and stormy weather

When e're we have a fight to fight

We will win it for the blue and gold

She our pride as spirit raises

As we stand to sing her praises

For we gladly do our school revere

And greet her with a rousing triple cheer

For old MU High

To you your sons are ever loyal

Old MU High

Your name will ever cherished be

For old MU High

We'll give a cheer for that royal

Old MU High

We'll love you ever more

Extracurriculars

The district offers a variety of clubs, activities and sports. Eligibility to participate is set by school board policies. The policy specifies that all students in Grades 9 through 12 must be passing five subjects at all times and two of those subjects must be core courses (math, English, science and social studies). In the event that a student, most likely a senior, is enrolled in three or less core subject areas, he/she will be required to be passing at least one core subject area to be eligible for athletic activities. All students in Grades 7 through 8 must maintain a passing grade in four full credit classes with two of those classes being core subject areas.[84]

By Pennsylvania law, all K-12 students in the district, including those who attend a private nonpublic school, cyber charter school, charter school and those homeschooled, are eligible to participate in the extracurricular programs, including all athletics. They must meet the same eligibility rules as the students enrolled in the district's schools.[85]

Athletics

- Baseball - Class AA

- Basketball - Class AA

- Cross Country - Class AA

- Football - Class AA

- Boys Golf - Class AA

- Softball - Class AA

- Track and Field - Class AA

- Volleyball - Class AA

- Wrestling - Class AA

References

- ↑ Pittsburgh Business Times (May 6, 2010). "Statewide Honor Roll Ranking 2010".

- ↑ Pittsburgh Business Times (May 23, 2007). "Three of top school districts in state hail from Allegheny County,".

- ↑ "2009 PSSA RESULTS Mount Union Area School District,". The Morning Call. Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ "Mount Union Area School District Academic Achievement Report Card 2010 data table". Retrieved February 15, 2011.

- ↑ The Times-Tribune (June 25, 2009). "Huntingdon County Graduation Rates 2008".

- ↑ Pennsylvania Partnerships for Children. "High School Graduation rate 2007". Retrieved January 31, 2011.

- ↑ Pennsylvania Department of Education. "Mount Union Area School District AYP Data". Retrieved February 15, 2010.

- ↑ Mount Union Area School District Administration. "Notice of Adequate Yearly Progress Public School Choice" (PDF).

- ↑ "2010 PSSAs: Reading, Math, Writing and Science Results".

- ↑ Pennsylvania Department of Education (September 14, 2010). "2009 PSSAs: Reading, Math, Writing and Science Results".

- ↑ "The 2008 PSSA Mathematics and Reading School Level Proficiency Results (by Grade and School Total)". August 2008.

- ↑ Pennsylvania Department of Education. "PSSA Math and Reading results by School and Grade 2007".

- ↑ "Math PSSA Scores by District 2007-08 Mount Union Area School District Results". The Times-Tribune. June 25, 2009.

- ↑ Pennsylvania Department of Education (January 2009). "Pennsylvania College Remediation Report".

- ↑ National Center for Education Statistics

- ↑ Pennsylvania Department of Education. "Pennsylvania Department of Education - Dual Enrollment Guidelines.".

- ↑ "Pennsylvania Transfer and Articulation Agreement.". March 2010.

- ↑ Pennsylvania Department of Education. (April 29, 2010). "Report: PA College Credit Transfer System Makes Higher Education More Affordable, Accessible".

- ↑ Mount Union Area School District Administration. "Mount Union Area School District Course Description".

- ↑ Mount Union Area School Administration (August 28, 2008). "Mount Union Area School District Strategic Plan Academic Standards and Assessment".

- ↑ "Pennsylvania Code §4.24 (a) High school graduation requirements".

- ↑ Pennsylvania Department of Education (September 2011). "Pennsylvania Keystone Exams Overview".

- ↑ Pennsylvania Department of Education (September 14, 2010). "Mount Union Area Junior High School Academic Achievement Report Card 2010" (PDF).

- ↑ Pennsylvania Department of Education. "PSSA Math and Reading Results 2007". Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ Pennsylvania Department of Education. "PSSA Results Math and Reading School 2008". Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ Pennsylvania Department of Education. "PSSA Science results 2008-09". Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ Pennsylvania Department of Education. "Science Results by School and Grade 2008". Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ Pennsylvania Bureau of Special Education (January 31, 2011). "Mount Union Area School District Special Education Data Report LEA Performance on State Performance Plan (SPP) Targets School Year 2008-2009" (PDF).

- ↑ Mount Union Area School District Administration (2010–2011). "Mount Union Area School District Special Education Department - Annual Public Notice of Special Education Services".

- ↑ Pennsylvania Department of Education Bureau of Special Education. "Pennsylvania Special Education Funding".

- ↑ Pennsylvania Department of Education (July 2010). "Special Education Funding from Pennsylvania State_2010-2011".

- ↑ Pennsylvania Department of Education (Revised December 1, 2009 Child Count (Collected July 2010)). "Gifted Students as Percentage of Total Enrollment by School District/Charter School" (PDF). Check date values in:

|date=(help) - ↑ Pennsylvania Department of Education and Pennsylvania School Board. "CHAPTER 16. Special Education For Gifted Students". Retrieved February 4, 2011.

- ↑ Pennsylvania Office of Safe Schools. "Mount Union Area School District School Safety Annual Report 2008 - 2009" (PDF). Retrieved February 15, 2011.

- ↑ "Pennsylvania Safe Schools Online Reports". February 2011.

- ↑ Mount Union Area School Board (September 27, 2010). "Bullying and Cyberbullying policy" (PDF).

- ↑ "Regular Session 2007-2008 House Bill 1067, Act 61 Section 6 page 8".

- ↑ "Center for Safe Schools of Pennsylvania, Bullying Prevention advisory". Retrieved January 2011. Check date values in:

|access-date=(help) - ↑ Pennsylvania Department of Education. "Pennsylvania Academic Standards".

- ↑ "Pa. Public School Salaries, 2009". Asbury Park Press. Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ "Mount Union Area School Payroll report". openpagov. Retrieved February 5, 201. Check date values in:

|access-date=(help) - ↑ Fenton, Jacob,. "Average classroom teacher salary in Huntingdon County, 2006-07.". The Morning Call. Retrieved March 2009. Check date values in:

|access-date=(help) - ↑ Teachers need to know enough is enough, PaDelcoTimes, April 20, 2010.

- ↑ "Mount Union Area School District Teachers Union Employment Contract 2011".

- ↑ "Legislature must act on educators' pension hole.". The Patriot News. February 21, 2010.

- ↑ Fenton, Jacob, (March 2009). "Average classroom teacher salary in Huntingdon County, 2006-07". The Morning Call.

- ↑ Fenton, Jacob. (Feb 2009). "Pennsylvania School District Data: Will School Consolidation Save Money?, '". The Morning Call.

- ↑ "Per Pupil Spending in Pennsylvania Public Schools in 2008 Sort by Administrative Spending".

- ↑ Pennsylvania Department of Education. "Fund Balances by Local Education Agency 1997 to 2008".

- ↑ Pennsylvania General Assembly. "Fund Balance Limitations Act 48 of 2003".

- ↑ "MOUNT UNION AREA SCHOOL DISTRICT HUNTINGDON COUNTY, PENNSYLVANIA PERFORMANCE AUDIT REPORT". August 2009.

- ↑ Pennsylvania Department of Revenue (October 2010). "Personal Income Tax Information".

- ↑ Pennsylvania house Appropriations Committee (August 2010). "PA House Appropriations Committee Basic Education Funding-Printout2 2010-2011".

- ↑ Office of Budget, (February 2010). "Pennsylvania Budget Proposal,".

- ↑ Pennsylvania Department of Education (October 2009). "Basic Education Funding by School District 2009-10".

- ↑ "Pennsylvania Department of Education Report on Funding by school district". October 2009.

- ↑ Pennsylvania Department of Education Funding Report by LEA 2009.

- ↑ Pennsylvania Department of Education. "Accountability Block Grant report 2010, Grantee list 2010".

- ↑ Pennsylvania Department of Education. "Accountability Block Grant Mid Year report".

- ↑ Jeff Gill (August 30, 2010). "Mount Union gets $2.5 million". The Altoona Mirror.

- ↑ Pennsylvania Department of Education press release (August 26, 2010). "Pennsylvania Department of Education Announces $101 Million in Federal Funds for Bold Reforms to Boost Student Achievement".

- ↑ Mount Union Area School District Administration (2009). "Mount Union Kistler Elementary School Continuous School Improvement Plan" (PDF).

- ↑ Pennsylvania Auditor General (2008-12-22). "Special Performance Audit Classrooms For the Future grants" (PDF).

- ↑ Commonwealth of Pennsylvania. "Huntingdon County ARRA FUNDING Report". Retrieved February 2011. Check date values in:

|access-date=(help) - ↑ Pennsylvania Department of Education Press Release (January 2009). "Pennsylvania's 'Race to the Top' Fueled by Effective Reforms, Strong Local Support".

- ↑ Pennsylvania's 'Race to the Top' Fueled by Effective Reforms, Strong Local Support

- ↑ U.S. Department of Education (March 29, 2010). "Race to the Top Fund,".

- ↑ Pennsylvania Department of Education. "Common Cents program - Making Every Dollar Count". Retrieved February 1, 2011.

- ↑ Pennsylvania Department of Education. "Finances_Real Estate Tax Rates 2010-11".

- ↑ Pennsylvania Department of Education,. "Act 511 Tax Report, 2004".

- ↑ Pennsylvania Department of Education. "Pennsylvania School District Finances_Real Estate Tax Rates_0910".

- ↑ Pennsylvania Department of Education. "Pennsylvania School District Real Estate Tax Rates 2008-09".

- ↑ Pennsylvania Department of Education 2010-11 Act 1 of 2006 Referendum Exception Guidelines.

- ↑ Pennsylvania Department of Education (May 2010). "Special Session Act 1 of 2006 School District Adjusted Index for 2006-2007 through 2011-2012".

- ↑ Pennsylvania Department of Education (April 2010). "Pennsylvania SSAct1_Act1 Exceptions Report 2010-2011 April 2010".

- ↑ Scarcella, Frank & Pursell, Tricia (May 25, 2010). "Local school tax assessments exceed state averages". The Daily Item.

- ↑ Pennsylvania Department of education Taxpayer Relief Act Special Session Act 1 of 2006 Report on Referendum Exceptions For School Year 2009-2010

- ↑ Pennsylvania Department of Education (May 2009). "Estimated Tax Relief Per Homestead and Farmstead May 1, 2009" (PDF).

- ↑ Pennsylvania Auditor General Office, (2010-02-23). "Special Report Pennsylvania Property Tax Relief,".

- ↑ Pennsylvania Department of Education, (May 2010). "Tax Relief per Homestead 5-1-10. Report".

- ↑ Pennsylvania Department of Education. "Property Tax/Rent Rebate Program".

- ↑ Tax Foundation (September 22, 2009). "New Census Data on Property Taxes on Homeowners,".

- ↑ http://www.muasd.org

- ↑ Mount Union Area School Board (2011). "Mount Union School District Policies".

- ↑ Pennsylvania Office of the Governor Press Release, (November 10, 2005). "Home-Schooled, Charter School Children Can Participate in School District Extracurricular Activities,".