International use of the U.S. dollar

Besides being the main currency of the United States, the American dollar is used as the standard unit of currency in international markets for commodities such as gold and petroleum (the latter, sometimes called petrocurrency, is the source of the term petrodollar). Some non-U.S. companies dealing in globalized markets, such as Airbus, list their prices in dollars.

The U.S. dollar is the world's foremost reserve currency. In addition to holdings by central banks and other institutions, there are many private holdings, which are believed to be mostly in one-hundred-dollar banknotes (indeed, most American banknotes actually are held outside the United States). All holdings of U.S.-dollar bank deposits held by non-residents of the United States are known as "eurodollars" (not to be confused with the euro), regardless of the location of the bank holding the deposit (which may be inside or outside the U.S.).

Economist Paul Samuelson and others (including, at his death, Milton Friedman) have maintained that the overseas demand for dollars allows the United States to maintain persistent trade deficits without causing the value of the currency to depreciate or the flow of trade to readjust. But Samuelson stated in 2005 that at some uncertain future period these pressures would precipitate a run against the U.S. dollar with serious global financial consequences.[1]

International reserve currency

The U.S. dollar is an important international reserve currency along with the euro. The euro inherited this status from the German mark, and since its introduction, has increased its standing considerably, mostly at the expense of the dollar. Despite the dollar's recent losses to the euro, it is still by far the major international reserve currency, with an accumulation more than double that of the euro.

In August, 2007, two scholars affiliated with the government of the People's Republic of China threatened to sell its substantial reserves in American dollars in response to American legislative discussion of trade sanctions designed to revalue the Chinese yuan.[2] The Chinese government denied that selling dollar-denominated assets would be an official policy in the foreseeable future.

Former Federal Reserve Chairman Alan Greenspan said in September 2007 that the euro could replace the U.S. dollar as the world's primary reserve currency. It is "absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency."[3]

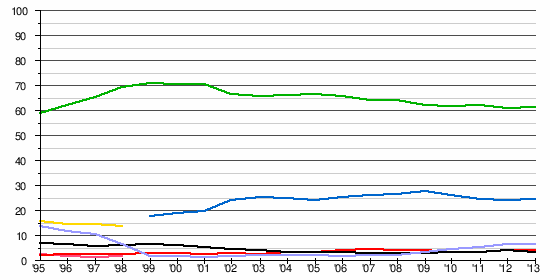

The percental composition of currencies of official foreign exchange reserves since 1995.[4][5][6]

U.S. Dollar Index

The U.S. Dollar Index (Ticker: USDX) is the creation of the New York Board of Trade (NYBOT), renamed in September 2007 to ICE Futures US. It was established in 1973 for tracking the value of the USD against a basket of currencies, which, at that time, represented the largest trading partners of the United States. It began with 17 currencies from 17 nations, but the launch of the euro subsumed 12 of these into one, so the USDX tracks only six currencies today.

| Euro | 57.6% |

| Japanese yen | 13.6% |

| Pound sterling | 11.9% |

| Canadian dollar | 9.1% |

| Swedish krona | 4.2% |

| Swiss franc | 3.6% |

| Source: ICE[7] | |

The Index is described by the ICE as "a geometrically-averaged calculation of six currencies weighted against the U.S. dollar."[7] The baseline of 100.00 on the USDX was set at its launch in March 1973. This event marks the watershed between the wider margins arrangement of the Smithsonian regime and the period of generalized floating that led up to the Second Amendment of the Articles of Agreement of the International Monetary Fund. Since 1973, the USDX has climbed as high as the 160s and drifted as low as the 70s.

The USDX has not been updated to reflect new trading realities in the global economy, where the bulk of trade has shifted strongly towards new partners like China and Mexico and oil-exporting countries while the United States has de-industrialized.

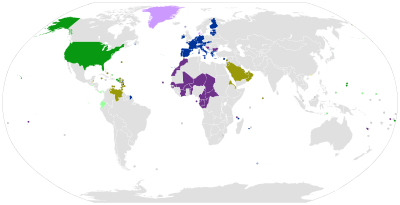

Dollarization and fixed exchange rates

Other nations besides the United States use the U.S. dollar as their official currency, a process known as official dollarization. For instance, Panama has been using the dollar alongside the Panamanian balboa as the legal tender since 1904 at a conversion rate of 1:1. Ecuador (2000), El Salvador (2001), and East Timor (2000) all adopted the currency independently. The former members of the U.S.-administered Trust Territory of the Pacific Islands, which included Palau, the Federated States of Micronesia, and the Marshall Islands, chose not to issue their own currency after becoming independent, having all used the U.S. dollar since 1944. Two British dependencies also use the U.S. dollar: the British Virgin Islands (1959) and Turks and Caicos Islands (1973). The islands Bonaire, Sint Eustatius and Saba, now collectively known as the Caribbean Netherlands, adopted the dollar on January 1, 2011, as a result of the dissolution of the Netherlands Antilles.[8][9]

The U.S. dollar is an official currency in Zimbabwe, along with the Euro, the Pound Sterling, the Pula, the Rand, plus several other currencies.

Some countries that have adopted the U.S. dollar issue their own coins: See Ecuadorian centavo coins, Panamanian Balboa and East Timor centavo coins.

A series of Zimbabwean Bond Coins has now been put into circulation (18 December 2014) in the following denominations - 1 Cent, 5, 10, and 25 Cents.

A 50 Cents Bond Coin was released in March 2015.

These coins are pegged at the same rate as American coins.

Some other countries link their currency to U.S. dollar at a fixed exchange rate. The local currencies of Bermuda and the Bahamas can be freely exchanged at a 1:1 ratio for USD. Argentina used a fixed 1:1 exchange rate between the Argentine peso and the U.S. dollar from 1991 until 2002. The currencies of Barbados and Belize are similarly convertible at an approximate 2:1 ratio. The Netherlands Antillean guilder (and its successor the Caribbean guilder) as well as the Aruban florin are pegged to the dollar at a fixed rate of 1:1.79. The East Caribbean dollar is pegged to the dollar at a fixed rate of 2.7:1, and is used by all of the countries and territories of the OECS other than the British Virgin Islands. In Lebanon, one dollar is equal to 1500 Lebanese pound, and is used interchangeably with local currency as de facto legal tender. The exchange rate between the Hong Kong dollar and the United States dollar has also been linked since 1983 at HK$7.8/USD, and pataca of Macau, pegged to Hong Kong dollar at MOP1.03/HKD, indirectly linked to the U.S. dollar at roughly MOP8/USD. Several oil-producing Arab countries on the Persian Gulf, including Saudi Arabia, peg their currencies to the dollar, since the dollar is the currency used in the international oil trade.

The People's Republic of China's renminbi was informally and controversially pegged to the dollar in the mid-1990s at ¥ 8.28/USD. Likewise, Malaysia pegged its ringgit at RM3.8/USD in September 1998, after the financial crisis. On July 21, 2005, both countries removed their pegs and adopted managed floats against a basket of currencies. Kuwait did likewise on May 20, 2007,[10] and Syria did likewise in July 2007.[11] However, after three years of slow appreciation, the Chinese yuan has been de facto re-pegged to the dollar since July 2008 at a value of ¥6.83/USD; although no official announcement had been made, the yuan has remained around that value within a narrow band since then, similar to the Hong Kong dollar.

Several countries use a crawling peg model, wherein currency is devalued at a fixed rate relative to the dollar. For example, the Nicaraguan córdoba is devauled by 5% per annum.[12]

Belarus, on the other hand, pegged its currency, the Belarusian ruble, to a basket of foreign currencies (U.S. dollar, euro and Russian ruble) in 2009.[13] In 2011 this led to a currency crisis when the government became unable to honor its promise to convert Belarusian rubles to foreign currencies at a fixed exchange rate. BYR exchange rates dropped by two thirds, all import prices rose and living standards fell.[14]

In some countries, such as Costa Rica and Honduras, the U.S. dollar is commonly accepted, although not officially regarded as legal tender. In Mexico's northern border area and major tourist zones, it is accepted as if it were a second legal currency. Many Canadian merchants close to the border, as well as large stores in big cities and major tourist hotspots in Peru also accept U.S. dollars, though usually at a value that favours the merchant. In Cambodia, U.S. notes circulate freely and are preferred over the Cambodian riel for large purchases,[15][16] with the riel used for change to break 1 USD. After the U.S. invasion of Afghanistan, U.S. dollars are accepted as if it were legal tender. Prices of most big ticket items such as houses and cars are set in U.S. dollars.

Dollar versus Euro

| Year | Highest ↑ | Lowest ↓ | ||||

|---|---|---|---|---|---|---|

| Date | Rate | Date | Rate | |||

| 1999 | 03 Dec | €0.9985 | 05 Jan | €0.8482 | ||

| 2000 | 26 Oct | €1.2118 | 06 Jan | €0.9626 | ||

| 2001 | 06 Jul | €1.1927 | 05 Jan | €1.0477 | ||

| 2002 | 28 Jan | €1.1658 | 31 Dec | €0.9536 | ||

| 2003 | 08 Jan | €0.9637 | 31 Dec | €0.7918 | ||

| 2004 | 14 May | €0.8473 | 28 Dec | €0.7335 | ||

| 2005 | 15 Nov | €0.8571 | 03 Jan | €0.7404 | ||

| 2006 | 02 Jan | €0.8456 | 05 Dec | €0.7501 | ||

| 2007 | 12 Jan | €0.7756 | 27 Nov | €0.6723 | ||

| 2008 | 27 Oct | €0.8026 | 15 Jul | €0.6254 | ||

| 2009 | 04 Mar | €0.7965 | 03 Dec | €0.6614 | ||

| 2010 | 08 Jun | €0.8374 | 13 Jan | €0.6867 | ||

| 2011 | 10 Jan | €0.7750 | 29 Apr | €0.6737 | ||

| 2012 | 24 Jul | €0.8272 | 28 Feb | €0.7433 | ||

| 2013 | 27 Mar | €0.7832 | 27 Dec | €0.7239 | ||

| 2014 | 31 Dec | €0.8237 | 8 May | €0.7167 | ||

| 2015 | 13 Apr | €0.9477 | 2 Jan | €0.8304 | ||

| Source: Euro exchange rates in USD, ECB | ||||||

Not long after the introduction of the euro (€; ISO 4217 code EUR) as a cash currency in 2002, and the Iraq War costs from 2003, the dollar began to depreciate steadily in value, as it did against other major currencies.[17] From 2003 to 2005, this depreciation continued, reflecting a widening current account deficit. Although the current account deficit began to stabilize in 2006 and 2007, depreciation persisted.[17] The fallout from the subprime mortgage crisis in 2008 prompted the Federal Reserve to lower interest rates in September 2007,[18] and again in March 2008,[19] sending the euro to a record high of $1.6038, reached in July 2008.[20]

In addition to the trade deficit, the U.S. dollar's decline was linked to a variety of other factors, including a major spike in oil prices.[21] Economists such as Alan Greenspan suggested that another reason for the decline of the dollar was its decreasing role as a major reserve currency. Chinese officials signaled plans to diversify the nation's $1.9 trillion reserve in response to a falling U.S. currency which also set the dollar under pressure.[22][23]

However, a sharp turnaround began in late 2008 with the onset of the global financial crisis. As investors sought out safe-haven investments in U.S. treasuries and Japanese government bonds from the financial turmoil, the Japanese yen and United States dollar sharply rose against other currencies, including the euro.[24] At the same time, however, many countries such as China,[25] India and Russia announced their intentions to diversify their foreign reserve portfolios away from the U.S. dollar.[26]

The European sovereign debt crisis that unfolded in 2010 sent the euro falling to a four-year low of $1.1877 on June 7, as investors considered the risk that certain Eurozone members may default on their government debt.[27] The euro's decline in 2008-2010 had erased half of its 2000-2008 rally.[20]

See also

References

- ↑ "China, U.S. should adjust approach to economic growth". English.people.com.cn. 2005-12-26. Retrieved 2010-08-24.

- ↑ Evans-Pritchard, Ambrose (2007-08-08). "China threatens 'nuclear option' of dollar sales.". The Daily Telegraph. London. Retrieved September 26, 2007.

- ↑ "Reuters". Euro could replace dollar as top currency - Greenspan. 2007-09-17. Retrieved September 17, 2007.

- ↑ Review of the International Role of the Euro (PDF), Frankfurt am Main: European Central Bank, December 2005, ISSN 1725-2210ISSN 1725-6593 (online).

- ↑ For 1995–99, 2006–12: "Currency Composition of Official Foreign Exchange Reserves (COFER)" (PDF). Washington, DC: International Monetary Fund. January 3, 2013.

- ↑ For 1999–2005: International Relations Committee Task Force on Accumulation of Foreign Reserves (February 2006), The Accumulation of Foreign Reserves (PDF), Occasional Paper Series, Nr. 43, Frankfurt am Main: European Central Bank, ISSN 1607-1484ISSN 1725-6534 (online).

- 1 2 "The ICE U.S. Dollar Index® and US Dollar Index Futures Contracts US Dollar Index" (PDF). June 2012. p. 2. Retrieved 5 October 2012.

- ↑ "Introduction of the US dollar on Bonaire, St Eustatius and Saba". sxmislandtime.com. 26 May 2010. Retrieved 2010-10-22.

- ↑ "US dollar introduced in Dutch Caribbean islands". Radio Netherlands Worldwide. 1 Jan 2011. Retrieved 2011-01-02.

- ↑ "Kuwait pegs dinar to basket of currencies". Forbes. 2007-05-20. Archived from the original on November 10, 2007. Retrieved 2007-06-06.

- ↑ "Syria to Drop Dollar Peg in July". Reuters. 2007-06-04. Archived from the original on 2008-01-10. Retrieved 2007-09-12.

- ↑ Rogers, Tim (May 13, 2014). "Nicaragua seeks to de-dollarize economy". The Nicaragua Dispatch.

- ↑ "New exchange rate will make Belarusian exports competitive, NBRB vows". State Customs Committee of the Republic of Belarus. 2009-01-06. Retrieved 2009-01-24.

- ↑ "Belarusian rouble falls sharply in value". BBC News. 2011-09-14.

- ↑ Chinese University of Hong Kong. "Historical Exchange Rate Regime of Asian Countries: Cambodia". Retrieved 2007-02-21.

- ↑ Kurt Schuler. "Tables of Modern Monetary History: Asia". Archived from the original on 2007-02-19. Retrieved 2007-02-21.

The U.S. dollar also circulates freely

- 1 2 "The Dollar's Depreciation and Inflation". Federal Reserve Bank of Cleveland. 2007-07-07.

- ↑ "ECB: euro exchange rates USD". Ecb.int. Retrieved 2010-08-24.

- ↑ "Dollar Falls to Record Low Versus Euro as Fed Signals Rate Cuts". Bloomberg. 2008-03-01.

- 1 2 Worrachate, Anchalee; Seki, Yasuhiko (2008-06-01). "Euro Weakens on Concerns Over Europe Spending Cuts". Bloomberg.

- ↑ "Oil Rises to Record on Weakening Dollar, Morgan Stanley Outlook". Bloomberg. 2008-06-06.

- ↑ Jeffrey Frankel. "What's Ahead: Decade of the Dollar, the Euro, or the RMB?". Archived from the original on October 31, 2005. Retrieved November 7, 2007.

- ↑ Adam S. Posen, "The Rise of the Euro: Currency Is Emerging as Rival to the Dollar," The Ripon Review July 2005

- ↑ David Gaffen (2008-10-22). "Somehow, the Dollar Regains Safe-Haven Status". The Wall Street Journal. Retrieved October 22, 2008.

- ↑ "Bloomberg.com: Worldwide". 2007-06-04. Retrieved 2007-11-04.

- ↑ Chris Buckley (2008-09-17). "China paper urges new currency order after "financial tsunami"". Reuters. Retrieved 2009-09-18.

- ↑ Levisohn, Ben; Worrachate, Anchalee (2008-06-10). "Euro Climbs Most Versus Dollar in Two Weeks on Outlook for Global Growth". Bloomberg.