FTSE 100 Index

|

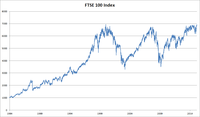

FTSE 100 Index performance between 1984 and 2015 | |

| Foundation | 1984[1] |

|---|---|

| Operator | FTSE Group[1] |

| Exchanges | London Stock Exchange[1] |

| Constituents | 101[1] |

| Type | Large cap |

| Market cap |

£1.7 trillion (as of Sept 2016)[1] |

| Weighting method | Capitalization-weighted[1] |

| Related indices | |

| Website |

www |

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" /ˈfʊtsi/, is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. It is seen as a gauge of prosperity for businesses regulated by UK company law. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

The index began on 3 January 1984 at the base level of 1000; the highest closing value reached to date is 7103.98 on 27 April 2015,[2] the previous peak having been over 15 years previously, on the last trading day of 1999, during the dot-com bubble.[3][4][5] After falling during the financial crisis of 2007-2010 to below 3500 in March 2009, the index recovered to a peak of 6091.33 on 8 February 2011, fell under the 5000 mark on the morning of 23 September 2011, but reached its record high on the market close of 27 April 2015, more than doubling in value from the crash in 2009. The highest intra-day value was 7,129 on 11 October 2016.[6]

Overview

The index is maintained by the FTSE Group, a now wholly owned subsidiary of the London Stock Exchange which originated as a joint venture between the Financial Times and the London Stock Exchange. It is calculated in real time and published every 1nbsp;seconds when the market is open.

The FTSE 100 consists of the largest 100 qualifying UK companies by full market value.[7] A large slice of these are international companies, however, so the index's movements are a fairly weak indicator of how the UK economy is faring.[8] A better indication of the UK economy is the FTSE 250 as it contains a smaller proportion of international companies.[9] The constituents of the FTSE are determined quarterly, on the Wednesday after the first Friday of the month in March, June, September and December. The values used to make the changes to the indices are taken at the close of business the night before the review.[10]

FTSE 100 companies represent about 81% of the entire market capitalisation of the London Stock Exchange. Even though the FTSE All-Share Index is more comprehensive, the FTSE 100 is by far the most widely used UK stock market indicator. Other related indices are the FTSE 250 Index (which includes the next largest 250 companies after the FTSE 100), the FTSE 350 Index (which is the aggregation of the FTSE 100 and 250), FTSE SmallCap Index and FTSE Fledgling Index. The FTSE All-Share aggregates the FTSE 100, FTSE 250 and FTSE SmallCap.

Component companies must meet a number of requirements set out by the FTSE Group, including having a full listing on the London Stock Exchange with a Sterling or Euro denominated price on the Stock Exchange Electronic Trading Service, and meeting certain tests on nationality, free float, and liquidity.

The constituent companies were criticised for their lack of diversity at the boardroom level in a 2014 study which found that more than half of them had no non-white board members, and two thirds did not have any executive directors from minorities.[11]

Continuous trading on the London Stock Exchange starts at 08:00 and ends at 16:30 (when the closing auction starts), and closing values are taken at 16:35.

Weighting

In the FTSE indices, share prices are weighted by market capitalisation, so that the larger companies make more of a difference to the index than smaller companies. The basic formula for these indices is:[12]

The Free float Adjustment factor represents the percentage of all issued shares that are readily available for trading. The factor is then rounded up to the nearest multiple of 5%. To find the free-float capitalisation of a company, first find its market cap (number of shares x share price) then multiply by its free-float factor. Free-float capitalisation, therefore, does not include restricted stocks, such as those held by company insiders.

Current constituents by market capitalisation as of February 2016

The following table lists the FTSE 100 companies measured by market capitalisation after the most recent changes on 15 February 2016.[13][14] The numbers of employees are taken from company reports, mostly dated between 2013 and 2015, and the Financial Times. The index consists of 100 companies, but there are 101 listings, as Royal Dutch Shell has both A and B class shares listed. Schroders Non Voting shares were also listed until 1 June 2012 when the FTSE's stricter rules came into force.

| Company | Ticker | Sector | Market cap (£bn) | Employees |

|---|---|---|---|---|

| 3i | III | Private equity | 4.06 | 266 |

| Aberdeen Asset Management | ADN | Fund management | 3.14 | 1,800 |

| Admiral Group | ADM | Insurance | 4.91 | 2,500 |

| Anglo American plc | AAL | Mining | 6.09 | 100,000 |

| Antofagasta | ANTO | Mining | 4.71 | 4,005 |

| ARM Holdings | ARM | Engineering | 13.2 | 2,000 |

| Ashtead Group | AHT | Equipment rental | 4.26 | 12,810 |

| Associated British Foods | ABF | Food | 25.77 | 102,000 |

| AstraZeneca | AZN | Pharmaceuticals | 51.23 | 57,200 |

| Aviva | AV. | Insurance | 17.69 | 40,800 |

| Babcock International | BAB | Engineering | 4.65 | 34,000 |

| BAE Systems | BA. | Military | 16.01 | 107,000 |

| Barclays | BARC | Banking | 27.18 | 150,000 |

| Barratt Developments | BDEV | Building | 5.86 | 5,000 |

| Berkeley Group Holdings | BKG | Building | 4.60 | 2,050 |

| BHP Billiton | BLT | Mining | 41.88 | 46,370 |

| BP | BP | Oil and gas | 63.13 | 97,700 |

| British American Tobacco | BATS | Tobacco | 71.4 | 87,813 |

| British Land | BLND | Property | 7.13 | 177 |

| BT Group | BT.A | Telecomms | 45.61 | 89,000 |

| Bunzl | BNZL | Industrial products | 6.38 | 12,368 |

| Burberry | BRBY | Fashion | 5.65 | 10,851 |

| Capita | CPI | Support Services | 7.38 | 46,500 |

| Carnival Corporation & plc | CCL | Leisure | 24.85 | 86,800 |

| Centrica | CNA | Energy | 10.72 | 40,000 |

| Coca-Cola HBC AG | CCH | Consumer | 5.1 | 38,312 |

| Compass Group | CPG | Food | 20.21 | 471,108 |

| CRH plc | CRH | Building materials | 10.9 | 76,433 |

| DCC plc | DCC | Investments | 5.03 | 9,804 |

| Diageo | DGE | Beverages | 46.01 | 25,000 |

| Direct Line Group | DLG | Insurance | 5.15 | 13,900 |

| Dixons Carphone | DC. | Retail | 5.16 | 40,000 |

| EasyJet | EZJ | Travel | 6.17 | 11,000 |

| Experian | EXPN | Information | 11.1 | 17,000 |

| Fresnillo plc | FRES | Mining | 6.99 | 2,449 |

| GKN | GKN | Manufacturing | 4.79 | 50,000 |

| GlaxoSmithKline | GSK | Pharmaceuticals | 67.38 | 97,389 |

| Glencore | GLEN | Mining | 16.96 | 57,656 |

| Hammerson | HMSO | Property | 4.42 | 277 |

| Hargreaves Lansdown | HL | Finance | 5.87 | 650 |

| Hikma Pharmaceuticals | HIK | Manufacturing | 3.71 | 6,000 |

| HSBC | HSBA | Banking | 88.11 | 267,000 |

| Imperial Brands | IMB | Tobacco | 35.78 | 38,200 |

| Inmarsat | ISAT | Telecomms | 4.47 | 1,590 |

| InterContinental Hotels Group | IHG | Hotels | 5.75 | 345,000 |

| International Consolidated Airlines Group SA | IAG | Travel | 11.01 | 58,476 |

| Intertek | ITRK | Product testing | 4.67 | 33,000 |

| Intu Properties | INTU | Property | 3.89 | 2,180 |

| ITV plc | ITV | Media | 10.15 | 4,059 |

| Johnson Matthey | JMAT | Chemicals | 4.79 | 9,700 |

| Kingfisher plc | KGF | Retail homeware | 7.8 | 80,000 |

| Land Securities | LAND | Property | 8.19 | 700 |

| Legal & General | LGEN | Insurance | 13.21 | 9,324 |

| Lloyds Banking Group | LLOY | Banking | 44.11 | 120,449 |

| London Stock Exchange Group | LSE | Finance | 8.06 | 4,692 |

| Marks & Spencer | MKS | Retailer | 7.01 | 81,223 |

| Merlin Entertainments | MERL | Leisure | 4.42 | 28,000 |

| Mondi | MNDI | Manufacturing | 6.37 | 26,000 |

| National Grid plc | NG | Energy | 36.14 | 27,000 |

| Next plc | NXT | Retail clothing | 6.9 | 58,706 |

| Old Mutual | OML | Insurance | 8.45 | 54,368 |

| Pearson PLC | PSON | Education | 6.52 | 37,000 |

| Persimmon plc | PSN | Building | 6.34 | 2,450 |

| Provident Financial | PFG | Finance | 4.74 | 3,110 |

| Prudential plc | PRU | Finance | 31.63 | 25,414 |

| Randgold Resources | RRS | Mining | 5.89 | 6,954 |

| Reckitt Benckiser | RB | Consumer goods | 46.32 | 32,000 |

| RELX Group | REL | Publishing | 25.54 | 28,500 |

| Rexam | REX | Packaging | 25.54 | 19,000 |

| Rio Tinto Group | RIO | Mining | 34.84 | 67,930 |

| Rolls-Royce Holdings | RR. | Manufacturing | 11.8 | 55,500 |

| Royal Bank of Scotland Group | RBS | Banking | 28.6 | 150,000 |

| Royal Dutch Shell | RDSA | Oil and gas | 160.12 | 90,000 |

| Royal Mail | RMG | Delivery | 4.41 | 150,000 |

| RSA Insurance Group | RSA | Insurance | 4.16 | 21,000 |

| SABMiller | SAB | Beverages | 67.32 | 70,000 |

| Sage Group | SGE | IT | 6.26 | 12,300 |

| Sainsbury's | SBRY | Supermarket | 5.02 | 150,000 |

| Schroders | SDR | Fund management | 6.63 | 3,012 |

| Severn Trent | SVT | Water | 5.04 | 8,051 |

| Shire plc | SHP | Pharmaceuticals | 22.52 | 4,200 |

| Sky plc | SKY | Media | 17.5 | 22,800 |

| Smith & Nephew | SN. | Medical | 10.27 | 11,000 |

| Smiths Group | SMIN | Engineering | 3.84 | 23,550 |

| Sports Direct | SPD | Retail | 2.4 | 17,210 |

| SSE plc | SSE | Energy | 14.03 | 19,965 |

| Standard Chartered | STAN | Banking | 13.52 | 86,865 |

| Standard Life | SL | Fund management | 6.63 | 10,500 |

| St. James's Place plc | STJ | Finance | 4.68 | 1,230 |

| Taylor Wimpey | TW. | Building | 5.99 | 3,860 |

| Tesco | TSCO | Supermarket | 14.92 | 519,671 |

| Travis Perkins | TPK | Retailer | 4.46 | 24,000 |

| TUI Group | TUI | Leisure | 5.99 | 76,000 |

| Unilever | ULVR | Consumer goods | 90.42 | 171,000 |

| United Utilities | UU | Water | 6.36 | 5,096 |

| Vodafone Group | VOD | Telecomms | 56.55 | 86,373 |

| Whitbread | WTB | Retail hospitality | 7.09 | 86,800 |

| Wolseley plc | WOS | Building materials | 9.20 | 44,000 |

| Worldpay | WPG | Payment services | 5.9 | 4,500 |

| WPP plc | WPP | Media | 19.01 | 162,000 |

Current constituents

The current constituents following the changes of 5 October 2016 are as follows:[15]

- 3i

- Admiral Group

- Anglo American

- Antofagasta

- Ashtead Group

- Associated British Foods

- AstraZeneca

- Aviva

- Babcock International

- BAE Systems

- Barclays

- Barratt Developments

- BHP Billiton

- BP

- British American Tobacco

- British Land Company

- BT Group

- Bunzl

- Burberry

- Capita

- Carnival

- Centrica

- Coca-Cola HBC

- Compass Group

- CRH

- Croda International

- DCC

- Diageo

- Direct Line

- Dixons Carphone

- easyJet

- Experian

- Fresnillo

- GKN

- GlaxoSmithKline

- Glencore

- Hammerson

- Hargreaves Lansdown

- Hikma Pharmaceuticals

- HSBC

- Imperial Brands

- Informa

- InterContinental Hotels Group

- International Airlines Group

- Intertek

- Intu Properties

- ITV

- Johnson Matthey

- Kingfisher

- Land Securities Group

- Legal & General

- Lloyds Banking Group

- London Stock Exchange Group

- Marks & Spencer

- Mediclinic International

- Merlin Entertainments

- Micro Focus International

- Mondi

- Morrisons

- National Grid

- Next

- Old Mutual

- Paddy Power Betfair

- Pearson

- Persimmon

- Polymetal International

- Provident

- Prudential

- Randgold Resources

- Reckitt Benckiser

- RELX Group

- Rio Tinto Group

- Rolls-Royce

- Royal Bank of Scotland Group

- Royal Dutch Shell

- Royal Mail

- RSA Insurance Group

- Sage Group

- J Sainsbury

- Schroders

- Severn Trent

- Shire

- Sky

- Smith & Nephew

- Smiths Group

- SSE

- Standard Chartered

- Standard Life

- St. James's Place

- Taylor Wimpey

- Tesco

- Travis Perkins

- TUI

- Unilever

- United Utilities

- Vodafone

- Whitbread

- Wolseley

- Worldpay

- WPP

Past constituents

- Abbey Life (became subsidiary of Lloyds TSB in 1996, then sold to Deutsche Bank in 2007)[16]

- Abbey National (acquired by Banco Santander Central Hispano, now part of its Santander UK subsidiary)[17]

- Aberdeen Asset Management (market capitalisation fell too low)

- African Barrick Gold (market capitalisation fell too low)

- Aggreko (market capitalisation fell too low)

- Alliance & Leicester (acquired by Banco Santander Central Hispano, now part of its Santander UK subsidiary)[18]

- Alliance Boots (acquired by private equity fund controlled by Kohlberg Kravis Roberts)[19]

- Alliance Trust (market capitalisation fell too low)

- Allied Domecq (acquired by Pernod Ricard)[20]

- Allied Zurich (dual holding company along with Zurich Allied, companies unified in 2000 to form Zurich Financial Services)[21]

- AMEC (market capitalisation fell too low)

- Amersham (acquired by GE, now part of its GE Healthcare division)[22]

- Amstrad (acquired by British Sky Broadcasting)[23]

- Argos (acquired by GUS and now owned by Home Retail Group)[24]

- Argyll Group (renamed Safeway in 1996, then taken over by Morrisons in 2004)[25]

- Arjo Wiggins Appleton (acquired by Worms & Cie)[26]

- ARM Holdings (acquired by SoftBank Group)[27]

- ASDA Group (acquired by Wal-Mart)[28]

- BAA (acquired by Ferrovial)[29]

- Balfour Beatty (market capitalisation fell too low)

- Baltimore Technologies (acquired by Oryx International Growth Fund)[30]

- Bank of Scotland (merged with Halifax to form HBOS, now part of the Lloyds Banking Group)[31]

- Barratt Developments (market capitalisation fell too low)

- Bass (became Six Continents and then InterContinental Hotels Group)[32]

- Beecham Group (merged with SmithKline and then with Glaxo to become GlaxoSmithKline)[33]

- Berisford (renamed Enodis, subsequently acquired by The Manitowoc Company)[34]

- Berkeley Group Holdings (market capitalisation fell too low)

- BET, formerly British Electric Traction (acquired by Rentokil, now Rentokil Initial)[35]

- BG Group (acquired by Royal Dutch Shell)[36]

- BICC (renamed Balfour Beatty)[37]

- Blue Arrow (acquired by Corporate Services Group)[38]

- Blue Circle Industries (acquired by Lafarge)[39]

- BOC (acquired by The Linde Group)[40]

- Bowater (renamed Rexam)[41]

- Bookham Technology (renamed Oclaro and now traded on Nasdaq)[42]

- BPB Industries (acquired by Saint-Gobain)[43]

- Bradford & Bingley (branch network acquired by Banco Santander Central Hispano, now part of its Santander UK subsidiary; loans book nationalised)[44]

- Brambles Industries (now only listed on the Australian Securities Exchange)[45]

- British Aerospace (merged with Marconi Electronic Systems to form BAE Systems)[46]

- British Airways (merged with Iberia to form International Airlines Group)[47]

- British Home Stores (acquired by Storehouse and then sold to Philip Green)[48]

- British Steel (merged with Koninklijke Hoogovens N.V. to become Corus Group, itself now part of Tata Steel)[49]

- British & Commonwealth (collapsed in 1990)[50]

- Britoil (acquired by BP)[51]

- BTR (merged with Siebe to form BTR Siebe, subsequently renamed Invensys)[52]

- Burmah Oil (renamed Burmah Castrol and acquired by BP)[53]

- Burton Group (renamed Arcadia and acquired by Philip Green)[54]

- Cable & Wireless Worldwide (market capitalisation fell too low)

- Cadbury (acquired by Kraft Foods)[55]

- Cairn Energy (market capitalisation fell too low)

- Carlton Communications (merged with Granada to form ITV)[56]

- Carphone Warehouse Group (market capitalisation fell too low)

- Celltech (acquired by UCB in 2004)[57]

- CMG (merged with Logica to form LogicaCMG)[58]

- Coats Viyella (acquired by Guinness Peat Group and renamed Coats)[59]

- Cobham (market capitalisation fell too low)

- COLT Telecom Group (market capitalisation fell too low)

- Commercial Union Assurance (merged with General Accident to form CGU, itself now part of Aviva)[60]

- Consolidated Gold Fields (acquired by Hanson)[61]

- Cookson Group (market capitalisation fell too low)

- Corus Group (acquired by Tata Steel, now forming its Tata Steel Europe division)[49]

- Courtaulds (demerged into two businesses acquired by Sara Lee and Akzo Nobel)[62]

- Daily Mail and General Trust (market capitalisation fell too low)

- Dalgety (renamed PIC International and then Sygen International and subsequently acquired by Genus)[63]

- Debenhams (market capitalisation fell too low)

- De La Rue (market capitalisation fell too low)

- Dimension Data Holdings (market capitalisation fell too low, subsequently acquired by Nippon Telegraph and Telephone)[64]

- Distillers (acquired by Guinness and now part of Diageo)[65]

- Dixons Group (renamed to DSG International and then Dixons Retail; market capitalisation also fell too low)[66]

- Dowty Group (acquired by TI Group, itself now part of Smiths Group)[67]

- DSG International (renamed Dixons Retail; market capitalisation also fell too low)[66]

- Eagle Star (acquired by BAT Industries and then demerged as part of Zurich Financial Services)[68]

- Eastern Group (acquired by Texas Utilities and then Powergen, now part of E.ON UK)[69]

- ECC Group (acquired by Imetal)[70]

- Edinburgh Investment Trust (market capitalisation fell too low)

- Electrocomponents (market capitalisation fell too low)

- EMAP (acquired by Apax and the Guardian Media Group)[71]

- EMI Group (acquired by Terra Firma Capital Partners, now owned by Citigroup)[72]

- Energis (acquired by Cable and Wireless)[73]

- English China Clays (acquired by Imetal)[70]

- Enterprise Inns (market capitalisation fell too low)

- Enterprise Oil (acquired by Royal Dutch Shell)[74]

- Essar Energy (market capitalisation fell too low)

- Eurasian Natural Resources Corporation (market capitalisation fell too low)

- Eurotunnel (market capitalisation fell too low)

- Evraz (market capitalisation fell too low)

- Exco International (acquired by British & Commonwealth Holdings)[75]

- Exel (acquired by Deutsche Post)[76]

- Ferranti International (collapsed in 1993)[77]

- Ferrexpo (market capitalisation fell too low)

- FirstGroup (market capitalisation fell too low)

- Fisons (acquired by Rhone-Poulenc Rorer, now Sanofi-Aventis)[78]

- Foreign & Colonial Investment Trust (market capitalisation fell too low)

- Forte (acquired by Granada, now ITV)[79]

- Freeserve (acquired by France Télécom, now Orange)[80]

- Friends Life (acquired by Aviva)[81]

- Friends Provident (acquired by Resolution Limited)[82]

- G4S (market capitalisation fell too low)

- Gallaher Group (acquired by Japan Tobacco)[83]

- Gateway Corporation (renamed Somerfield, subsequently acquired by The Co-operative Group)[84]

- GEC, formerly General Electric Company (renamed Marconi and then Telent)[85]

- General Accident (merged with Commercial Union to form CGU, itself now part of Aviva)[60]

- George Wimpey (merged with Taylor Woodrow to form Taylor Wimpey)[86]

- Glaxo Wellcome (merged with SmithKline Beecham to form GlaxoSmithKline)[33]

- Globe Investment Trust (acquired by British Coal Pension Fund)[87]

- Granada Compass (split in 2001 to leave Granada and Compass Group)[88]

- Granada (merged with Carlton Communications to form ITV)[56]

- Greenall's Group (renamed De Vere Group and then acquired by a joint venture of private investors)[89]

- Grand Metropolitan (merged with Guinness to form Diageo)[90]

- Guardian Royal Exchange (acquired by Axa)[91]

- Guinness (merged with Grand Metropolitan to form Diageo)[90]

- GUS (now demerged into Home Retail Group and Experian)[92]

- Habitat Mothercare (merged with British Home Stores to form Storehouse and subsequently renamed Mothercare again)[93]

- Halifax Group (merged with the Bank of Scotland to form HBOS)[31]

- Hambro Life (renamed Allied Dunbar and acquired by BAT Industries and then demerged as part of Zurich Financial Services)[94]

- Hanson (acquired by Heidelberg Cement)[95]

- Harrisons & Crosfield (renamed Elementis)[96]

- Hawker Siddeley (acquired by BTR, now Invensys)[97]

- Hays (market capitalisation fell too low)

- HBOS Group plc (acquired by Lloyds TSB, now Lloyds Banking Group)[98]

- Hikma Pharmaceuticals (market capitalisation fell too low)

- Hillsdown Holdings (acquired by Hicks, Muse, Tate and Furst and then sold on as Premier Foods)[99]

- Home Retail Group (market capitalisation fell too low)

- House of Fraser (acquired by Baugur)[100]

- ICAP (market capitalization fell too low)

- IMI (market capitalization fell too low)

- Imperial Chemical Industries (acquired by Akzo Nobel)[101]

- Imperial Continental Gas Association (broke up into Calor and Contibel)[102]

- Inchcape (market capitalisation fell too low)

- Inmarsat (market capitalisation fell too low)

- Innogy Holdings (renamed Npower and acquired by RWE)[103]

- International Power (acquired by GDF Suez)[104]

- Intu Properties (market capitalisation fell too low)

- Invensys (market capitalisation fell too low)

- Invesco (moved primary listing to NYSE)[105]

- Investec (market capitalisation fell too low)

- Jaguar (acquired by Ford and then by Tata Motors)[106]

- Kazakhmys (market capitalisation fell too low)

- Kelda Group (acquired by Saltaire Water consortium)[107] a consortium of investment companies including Citigroup and HSBC.[108]

- Kingston Communications (renamed KCOM Group and market capitalisation fell too low)[109]

- Kwik Save Group (merged with Somerfield)[110]

- Ladbrokes (market capitalisation fell too low)

- Laporte (major divisions acquired by Kohlberg Kravis Roberts)[111]

- Lasmo (acquired by Eni)[112]

- Lattice Group (merged with National Grid to form National Grid Transco)[113]

- Logica (market capitalisation fell too low)

- London Electricity (acquired by Électricité de France, now part of its EDF Energy division)[114]

- Lonhro (renamed Lonmin)[115]

- Lonmin (market capitalisation fell too low)

- Lucas Industries (merged with Varity to form LucasVarity, then acquired by TRW)[116]

- LucasVarity (acquired by TRW)[116]

- Magnet and Southerns (acquired by Berisford)[117]

- Man Group (market capitalisation fell too low)

- Maxwell Communications Corporation (collapsed in 1991)[118]

- MB-Caradon (renamed Caradon and then Novar, then acquired by Honeywell)[119]

- Melrose (market capitalisation fell too low)

- Meggitt (market capitalisation fell too low)

- MEPC (acquired by Leconport Estates)[120]

- Mercury Asset Management (acquired by Merrill Lynch)[121]

- MFI Furniture (renamed Galiform and then Howden Joinery and market capitalisation fell too low)[122]

- Midlands Electricity (acquired by Acquila Sterling, now part of E.ON UK)[123]

- Midland Bank (acquired by HSBC)[124]

- Misys (market capitalisation fell too low)

- Mitchells & Butlers (market capitalisation fell too low)

- National Westminster Bank (acquired by Royal Bank of Scotland Group)[125]

- NFC (merged with Ocean Group to form Exel, now part of Deutsche Post)[126]

- Northern Foods (market capitalisation fell too low, before being acquired by Ranjit Boparan)[127]

- Northern Rock (market capitalisation fell too low, before being nationalised)[128]

- Norwich Union (merged with CGNU to form Aviva)[60]

- Nycomed Amersham (acquired by GE)[22]

- O2 (renamed Telefónica Europe following acquisition by Telefónica)[129]

- Orange (acquired by Mannesmann and then by France Télécom, now Orange)[130]

- PartyGaming (market capitalisation fell too low, before merging with Bwin to become bwin.party digital entertainment)[131]

- P&O (acquired by Dubai Ports World)[132]

- P&O Princess Cruises (merged with Carnival Corporation and re-listed as Carnival PLC)[133]

- Pennon Group (market capitalisation fell too low)

- Persimmon (market capitalisation fell too low)

- Petrofac (market capitalisation fell too low)

- Pilkington (acquired by Nippon Sheet Glass)[134]

- Plessey (acquired by GEC and Siemens)[135]

- Polly Peck (collapsed in 1990)[136]

- PowerGen (acquired by E.ON UK)[137]

- Provident Financial (market capitalisation fell too low)

- Psion (market capitalisation fell too low)

- Punch Taverns (market capitalisation fell too low)

- Racal Electronics (acquired by Thomson-CSF and then Thales Group)[138]

- Railtrack (collapsed in 2001)[139]

- Rank Hovis McDougall (acquired by Premier Foods)[140]

- Reckitt and Coleman (merged with Benckiser to form Reckitt Benckiser)[141]

- Redland (acquired by Lafarge)[142]

- Reed International (merged with Elsevier to form Reed Elsevier)[143]

- Rentokil Initial (market capitalisation fell too low)

- Resolution Limited (changed its name to Friends Life Group)[144]

- Resolution plc (acquired by Pearl Group)[145]

- Rexam (acquired by Ball Corporation)[146]

- RMC Group (acquired by Cemex)[147]

- Rothmans International (acquired by British American Tobacco)[148]

- J Rothschild (renamed St. James's Place and market capitalisation fell too low)[149]

- Rowntree's (acquired by Nestlé)[150]

- Royal Insurance (merged with Sun Alliance Group to form Royal & SunAlliance)[151]

- Saatchi & Saatchi (acquired by Publicis)[152]

- Safeway (acquired by Morrisons)[153]

- SABMiller (acquired by Anheuser-Busch InBev)[154]

- Scottish & Newcastle (acquired by a consortium formed of Heineken & Carlsberg)[155]

- Scottish Hydro Electric (merged with Southern Electric to form Scottish and Southern Energy)[156]

- Scottish Power (acquired by Iberdrola)[157]

- Sears (acquired by January Investments - itself controlled by Philip Green)[158]

- Securicor (merged with Group 4 Falck to form G4S)[159]

- Sedgwick (acquired by Marsh & McLennan)[160]

- Segro (market capitalisation fell too low)

- Sema Group (acquired by Schlumberger)[161]

- Serco (market capitalisation fell too low)

- Shell Transport and Trading Company (now re-organised with Royal Dutch Petroleum Company as Royal Dutch Shell)[162]

- Siebe (merged with BTR to form Invensys)[52]

- SmithKline Beecham (merged with Glaxo Wellcome to form GlaxoSmithKline)[33]

- Smiths Industries (renamed to Smiths Group)[163]

- Southern Electric (merged with Scottish Hydro Electric to form Scottish and Southern Energy)[156]

- Spirent (market capitalisation fell too low)

- Sports Direct (market capitalisation fell too low)

- Stagecoach Group (market capitalisation fell too low)

- Standard Telephones and Cables (renamed STC and acquired by Nortel)[164]

- Storehouse (renamed Mothercare)[165]

- Sun Alliance Group (merged with Royal Insurance to form Royal & Sun Alliance)[151]

- Sun Life Assurance (acquired by Axa)[166]

- Sun Life & Provincial Holdings (acquired by Axa)[166]

- Tarmac (acquired by Anglo American)[167]

- Tate & Lyle (market capitalisation fell too low)

- Taylor Wimpey (market capitalisation fell too low)

- Taylor Woodrow (merged with George Wimpey to form Taylor Wimpey)[86]

- Telewest Communications (merged with NTL to form NTL:Telewest now Virgin Media)[168]

- Thames Water (acquired by RWE and then sold to Macquarie Bank)[169]

- The Energy Group (acquired by Texas Utilities and then by E.ON UK)[69]

- Thomas Cook Group (market capitalisation fell too low)

- Thomson Reuters (delisted shares from the London Stock Exchange as it ceased to be a dual-listed company)[170]

- Thorn (acquired by Nomura Group)[171]

- Thorn EMI (renamed EMI Group and then acquired by Terra Firma Capital Partners)[171]

- Thus (market capitalisation fell too low, subsequently acquired by Cable & Wireless Worldwide)[172]

- TI Group (acquired by Smiths Group)[173]

- Tomkins (acquired by Onex Corporation and Canada Pension Plan Investment Board)[174]

- Trafalgar House (acquired by Kværner)[175]

- TSB Group (merged with Lloyds Bank to form Lloyds TSB)[176]

- Trusthouse Forte (acquired by Granada)[79]

- TUI Travel (market capitalisation fell too low)

- Tullow Oil (market capitalisation fell too low)

- Ultramar (acquired by LASMO and now part of Eni)

- Unigate (renamed Uniq, then market capitalisation fell too low)[177]

- United Biscuits (acquired by consortium of financial investors)[178]

- United Business Media (market capitalisation fell too low)

- Vedanta Resources (market capitalisation fell too low)

- Warburg SG (acquired by Swiss Bank Corporation, now part of UBS)[179]

- Weir Group (market capitalisation fell too low)

- Wellcome (merged with Glaxo to form Glaxo Wellcome, then with SmithKline Beecham to form GlaxoSmithKline)[33]

- W H Smith (market capitalisation fell too low)

- William Hill (market capitalisation fell too low)

- Williams Holdings (demerged into Kidde and Chubb Security, both now part of United Technologies Corporation)[180]

- Willis Corroon (acquired by Trinity Acquisition on behalf of Kohlberg Kravis Roberts and renamed Willis Group)[181]

- Willis Faber (acquired by Trinity Acquisition on behalf of Kohlberg Kravis Roberts and renamed Willis Coroon and then Willis Group)[181]

- Wood Group (market capitalisation fell too low)

- Woolwich (acquired by Barclays)[182]

- Yell Group (market capitalisation fell too low)

- Zeneca (merged with Astra to form AstraZeneca)[183]

source: "FTSE: FTSE 100 Constituent Changes" (PDF). (57.9 KB)

FT 30

The oldest continuous index in the UK is the FT 30, also known as the Financial Times Index or the FT Ordinary Index (FTOI).[184] It was established in 1935 and nowadays is largely obsolete due to its redundancy. It is similar to the Dow Jones Industrial Average, and companies listed are from the industrial and commercial sectors. Financial sector companies and government stocks are excluded.

Of the original constituents,[185] four are currently in the FTSE 100: Guest Keen & Nettlefolds (GKN), Tate & Lyle, Imperial Tobacco and Rolls-Royce, although Rolls-Royce has not been continuously listed and Imperial Tobacco was a subsidiary of Hanson for a number of years. ICI was removed when it was taken over by Akzo Nobel in January 2008. Two of the original FT 30 companies are still in that index:[186] GKN and Tate & Lyle (membership is not strictly based on market capitalisation, so this does not mean they are necessarily among the top thirty companies in the FTSE 100). The best performer from the original lineup has been Imperial Tobacco.[187]

See also

- Other lists

- List of largest companies by revenue, worldwide

- List of corporate collapses and scandals, on major bankruptcies historically and worldwide

- List of largest United Kingdom employers, including the public sector

- List of private equity firms

- List of largest private companies in the United Kingdom

- List of hedge funds

- Stock market lists

- List of stock market indices

- Financial Times Global 500, the BBC Global 30 and the Fortune Global 500, list the world's largest corporations by market capitalisation

- FTSE 250 and FTSE techMARK 100, a longer FT list, and one for the "new economy"

- Dow Jones and the DAX 30, equivalent to the FT 30 in the US and Germany

- S&P 100 and the HDAX, top 100 in the US and top 110 in Germany

- AEX index

Notes

- 1 2 3 4 5 6 "FTSE 100 Index Factsheet" (PDF). FTSE Group. Retrieved 24 October 2016.

- ↑ "HSBC gives FTSE 100 renewed boost". bbc.co.uk. Retrieved 27 April 2015.

- ↑ "FTSE 100 beats all-time high after 15 years". FTSE Global Markets. 24 February 2015. Retrieved 15 May 2015.

- ↑ "FTSE 100: INDEXFTSE:UKX quotes & news - Google Finance". google.ca. Retrieved 23 March 2015.

- ↑ "Can FTSE 100 break 7,000 mark?". scotsman.com. Retrieved 24 February 2015.

- ↑ "FTSE 100 hits record high as pound weakens".

- ↑ Ground Rules for the Management of The UK Series of the FTSE Actuaries Share Indices (section 5)

- ↑ Atkins, Ralph; Elder, Bryce (3 September 2014). "FTSE returns to dotcom bubble level". ft.com. Retrieved 8 September 2014.

- ↑ "Which indices best represent the economy?". Hargreaves Lansdown. Retrieved 9 May 2015.

- ↑ FTSE UK Quarterly Review

- ↑ Murphy, Joe (20 April 2015). "Half of FTSE 100 firms have no non-whites at top". London Evening Standard. p. 2.

- ↑ FTSE Capitalisation methodology via Wikinvest

- ↑ "Royal Dutch Shell (UK): Acquisition of BG Group (UK)". FTSE. 10 February 2016. Retrieved 15 February 2016.

- ↑ See 'FTSE All-Share Index Ranking (unofficial guide)'

- ↑ "SABMiller (UK): Acquisition by Anheuser-Busch InBev (Belgium) Changes in FTSE UK Index Series". FTSE. 30 October 2016. Retrieved 10 October 2016.

- ↑ Buoyant Lloyds TSB offloads insurer Abbey Life The Guardian, 1 August 2007

- ↑ William Kay (6 September 2004). "HBOS fury as EU backs Santander's Abbey bid". The Independent. London.

- ↑ "A&L shareholders approve takeover". BBC News. 16 September 2008. Retrieved 17 September 2008.

- ↑ "Terra Firma drops Boots bid plan". BBC News. 24 April 2007. Retrieved 25 October 2012.

- ↑ Pernod Ricard successfully completes acquisition of Allied Domecq, from the Pernod Ricard website

- ↑ Unification of companies Archived 26 January 2011 at the Wayback Machine.

- 1 2 "General Electric buys Amersham". BBC. 10 October 2003. Retrieved 12 June 2009.

- ↑ "BSkyB agrees £125m Amstrad deal". BBC News. 31 July 2007. Retrieved 31 July 2007.

- ↑ "Argos attacks GUS offer". BBC News. 26 February 1998. Retrieved 13 October 2009.

- ↑ Argyll Group plc intends a stock buy back

- ↑ Worms & Cie launches tender offer

- ↑ "SoftBank finally completes £24bn ARM takeover". Silicon Republic. 5 December 2016. Retrieved 5 September 2016.

- ↑ "Wal-Mart buys Asda in UK retail shock". Eurofood. 17 June 1999. Retrieved 6 April 2008.

- ↑ The Economist, The man who bought trouble. Consulted on 18 July 2007.

- ↑ International Trader

- 1 2 "Bank of Scotland and Halifax agree merger". BBC News. 4 May 2001. Retrieved 25 October 2012.

- ↑ Bass to become Six Continents The Guardian, 27 June 2001

- 1 2 3 4 "The Glaxo SmithKline merger". BBC News. 17 January 2000. Retrieved 25 October 2012.

- ↑ Bryan, Victoria (14 October 2008). "Enodis sees FY profit ahead of its view". Reuters. Retrieved 24 November 2008.

- ↑ Rumours of Rentokil bid boost BET The Independent, 15 February 1996

- ↑ Jess McHugh. "Shell-BG Group Acquisition Complete, As Energy Giant Focuses On Liquefied Natural Gas". International Business Times. Retrieved 15 February 2016.

- ↑ "Shake-up will see BICC change to Balfour Beatty". Findarticles.com. Retrieved 25 October 2012.

- ↑ "Tony Berry, former Chairman, Blue Arrow". Managementtoday.co.uk. Retrieved 25 October 2012.

- ↑ Lafarge bags Blue Circle The Daily Telegraph (London), 7 January 2001

- ↑ Statement on Linde homepage

- ↑ Bowater to change name to Rexam Plasteurope, 31 May 1995

- ↑ Avanex and Bookham become Oclaro Compound Semiconductor, 28 April 2009

- ↑ "BPB accepts bid from French firm". BBC News. 17 November 2005. Retrieved 25 October 2012.

- ↑ "Spanish bank giant to acquire B&B". BBC News. 29 September 2008. Retrieved 29 September 2008.

- ↑ Brambles ditches London listing The Telegraph, 30 November 2005

- ↑ BAe set to sign A8bn GEC deal with merger The Guardian, 19 January 1999

- ↑ "Iberia expects to complete merger with British Airways in January". Daily Nation. 27 October 2010. Retrieved 18 November 2010.

- ↑ "BHS sold to M&S raider". BBC News. 27 March 2000. Retrieved 25 October 2012.

- 1 2 "India's Tata wins race for Corus". BBC. 31 January 2007. Retrieved 26 November 2007.

- ↑ Law Lords Department. "Judgments – Soden and Another v. British & Commonwealth Holdings Plc. and Others". Publications.parliament.uk. Retrieved 6 February 2011.

- ↑ Competition Commission Report 1988 Page 10

- 1 2 "Investors back BTR Siebe merger". Findarticles.com. Retrieved 25 October 2012.

- ↑ "BP buys Burmah Castrol". BBC News. 14 March 2000. Retrieved 25 October 2012.

- ↑ "Arcadia's clearance sale". BBC News. 4 April 2001. Retrieved 25 October 2012.

- ↑ "Cadbury agrees Kraft takeover bid". London: BBC News. 19 January 2010. Retrieved 19 January 2010.

- 1 2 "ITV shares on London stock market". BBC News. 2 February 2004. Retrieved 25 October 2012.

- ↑ HEATHER TIMMONS (19 May 2004). "Belgian drugmaker seeks to buy Celltec". New York Times. Retrieved 25 October 2012.

- ↑ Richard Wray (9 October 2002). "Jobs cull logical in Logica / CMG deal". London: Guardian. Retrieved 25 October 2012.

- ↑ Weiss exits Guinness Peat but stays on at Coats The Australian, 1 April 2011

- 1 2 3 "CGU and Norwich Union merge". BBC News. 21 February 2000. Retrieved 2 November 2010.

- ↑ Obituary: Lord Hanson The Times, 3 November 2004

- ↑ Akzo Nobel Buys Courtaulds & Columbian Firm Adhesives Age, 1 June 1998

- ↑ PIC International Group PLC Changes Name to Sygen International plc PR Newswire, 2001

- ↑ "NTT buys South Africa's Dimension Data". BBC News. 14 July 2010. Retrieved 14 July 2010.

- ↑ Guinness directors showed 'contempt for truth' BBC, 28 November 1997

- 1 2 DSG, formerly known as Dixons, is now renamed ... Dixons The Telegraph, 25 June 2010

- ↑ British engineering firms merger moves forward New York Times, 1992

- ↑ "Eagle Star at Euroarchive". Euroarchiveguide.org. 15 September 1904. Retrieved 25 October 2012.

- 1 2 Texas raises Energy bid to £4.46bn BBC News, 3 March 1998

- 1 2 Imetal to Buy ECC For $1.2 Billion ICIS, 8 February 1999

- ↑ Andrews, Amanda (24 December 2007). "Guardian and Apax snap up a fifth of Emap". The Times. London. Retrieved 1 May 2010.

- ↑ "Profile: British music giant EMI". BBC News. 15 January 2008. Retrieved 16 March 2008.

- ↑ Odell, Mark (15 August 2005). "C&W set to win Energis race". News.ft.com. Retrieved 25 October 2012.

- ↑ "Royal Dutch/Shell Will Buy Enterprise Oil of Britain". nytimes.com. 3 April 2002. Retrieved 24 February 2015.

- ↑ Chairman is appointed at Exco International New York Times, 8 January 1987

- ↑ Deutsche Post (14 December 2005). "Deutsche Post DHL Completes Acquisition of Exel". Archived from the original on 22 October 2008. Retrieved 7 November 2008.

- ↑ Ferranti Timeline – Museum of Science and Industry (Accessed 17 February 2009)

- ↑ Door still open for agreed takeover of Fisons The Independent, 22 August 1995

- 1 2 "Granada buys maximum stake". findarticles.com. Retrieved 24 February 2015.

- ↑ "BBC NEWS - Business - French rival clinches Freeserve deal". bbc.co.uk. Retrieved 24 February 2015.

- ↑ "Aviva and Friends Life rise in first day as a merged company". The Telegraph. 13 April 2015. Retrieved 15 April 2015.

- ↑ "Friends backs Resolution takeover". BBC News. 11 August 2009.

- ↑ Gallaher agrees £7.5bn Japan Tobacco takeover The Scotsman

- ↑ "Co-op buys Somerfield for £1.57bn". bbc.co.uk. 16 July 2008. Retrieved 16 July 2008.

- ↑ Oates, John (25 October 2005). "Ericsson buys Marconi". Theregister.co.uk. Retrieved 5 June 2010.

- 1 2 "BBC NEWS - Business - Wimpey and Woodrow agree to merge". bbc.co.uk. Retrieved 24 February 2015.

- ↑ Closed-End Funds Open Plays for the Intrepid Investor International Herald Tribune, 21 January 1995

- ↑ "Catering & Hospitality News". Retrieved 24 February 2015.

- ↑ Lloyds-backed Alternative Hotels Group may be sold Daily Mail, 12 February 2011

- 1 2 Spirits soar at Diageo Food & Drug Packaging, July 2005

- ↑ Axa of France to buy Guardian of Britain New York Times, 2 February 1999

- ↑ "Breaking News, World News & Multimedia".

- ↑ "The Independent - 404". The Independent. Retrieved 24 February 2015.

- ↑ Openwork: History

- ↑ Richard Blackden, Online City Editor (15 May 2007). "Heidelberg to buy Hanson for £8bn". Telegraph.co.uk. Retrieved 24 February 2015.

- ↑ "AIM25 collection description". aim25.ac.uk. Retrieved 24 February 2015.

- ↑ Brush Traction: History

- ↑ "Lloyds TSB Seals Merger with HBOS". BBC News. 17 September 2008. Retrieved 17 September 2008.

- ↑ "COMPANY NEWS - HICKS, MUSE BUYING A BRITISH FOOD COMPANY - NYTimes.com". nytimes.com. 15 May 1999. Retrieved 24 February 2015.

- ↑ "BBC NEWS - Business - House of Fraser agrees Baugur bid". bbc.co.uk. Retrieved 24 February 2015.

- ↑ Armitstead, Louise (5 August 2007). "Dutch poised to clinch £8bn ICI takeover". The Times. London. Retrieved 5 January 2008.

- ↑ Gulf Resources & Chemical Corporation

- ↑ RWE is set to buy Innogy New York Times, 18 March 2002

- ↑ Scott, Mark (16 April 2012). "GDF Suez to Buy Remaining Stake in British Utility for $10 Billion". The New York Times. Retrieved 6 June 2012.

- ↑ "LSE to replace Invesco in UK's FTSE 100". Reuters. 30 November 2007. Retrieved 1 December 2007.

- ↑ "The Years 1989 to 1996". Jaguar Cars Ltd. Retrieved 10 May 2007.

- ↑ "Kelda Group PLC (UK): Scheme of Arrangement". FTSE Group. 4 February 2008. Retrieved 18 February 2008.

- ↑ Larkin, Nicholas (8 February 2008). "Montagu, Partners to Buy Biffa for 1.2 Billion Pounds". Bloomberg. Retrieved 18 February 2008.

- ↑ Kingston Communications changes name to KCOM Group Comms Dealer, 16 August 2007

- ↑ "Kwik Save weighs heavily on Somerfield results". FoodAndDrinkEurope.com (Decision News Media SAS). 9 April 2003. Retrieved 5 May 2007.

- ↑ Rockwood launched Chemical Market Reporter, December 2000

- ↑ Eni swoops on Lasmo BBC News, 21 December 2000

- ↑ Grid and Lattice form utility supergroup The Telegraph, 22 April 2002

- ↑ London Electricity goes to France BBC News, 30 November 1998

- ↑ The Investment Case – Lonmin plc Moneyweb, 1 April 2011

- 1 2 "COMPANY NEWS - TRW IS NEAR DEAL TO BUY LUCAS VARITY - NYTimes.com". nytimes.com. 26 January 1999. Retrieved 24 February 2015.

- ↑ Berisford International PLC acquires Magnet Ltd(Water Meadow Hldg) from Magnet Group PLC Alacrastore, 3 March 1994

- ↑ Bankruptcy Explanation By Maxwell New York Times, 18 December 1991

- ↑ "Novar plc - Company Profile, Information, Business Description, History, Background Information on Novar plc". referenceforbusiness.com. Retrieved 24 February 2015.

- ↑ Harrold heralds start of new era at MEPC: Hermes man outlines new business plan for developer Property Week, 24 October 2003

- ↑ Merrill cleared to buy British Fund Manager New York Times, 24 December 1997

- ↑ MFI sells store chain in £1 deal BBC News, 22 September 2006

- ↑ "Aquila Completes Purchase of Ownership Interest in Midlands Electricity.". Business Wire. 8 May 2002. Retrieved 5 September 2008.

- ↑ "HSBC - Page no longer exists" (PDF). hsbc.com. Retrieved 24 February 2015.

- ↑ Farrelly, Paul RBS issues ultimatum in £27bn bid for NatWest The Observer, 28 November 1999

- ↑ NFC and Ocean forge £3.2bn alliance to exploit e-commerce The Independent, 22 February 2000

- ↑ Boparan wins Northern Foods with £341m bid FT.com

- ↑ "Northern Rock to be nationalised". BBC News. 17 February 2008. Retrieved 8 April 2008.

- ↑ "Telefonica bids £18 billion for U.K.'s O2". BBC News. 31 October 2005. Retrieved 25 April 2010.

- ↑ "France Télécom to buy Orange for £25.1bn". London: The Independent. 30 May 2000. Retrieved 26 December 2008.

- ↑ "Gambling firms Partygaming and Bwin reveal merger plan". BBC News. 29 July 2010. Retrieved 29 July 2010.

- ↑ P&O agrees bid from Dubai Ports BBC News, 29 November 2005

- ↑ EC Clears Carnival and P&O Princess Merge Marinelink, 11 February 2003

- ↑ "BBC NEWS - Business - Pilkington in Japanese takeover". bbc.co.uk. Retrieved 24 February 2015.

- ↑ "Circuit Breakers, Fusegear, Isolators, Fuse Switches – IPD Group Limited".

- ↑ Bates, Stephen (26 August 2010). "How Polly Peck went from hero to villain in the City". The Guardian. London. Retrieved 26 August 2010.

- ↑ "E.ON to buy Powergen".

- ↑ Thomson-CSF seals Racal deal BBC News (13 January 2000) Accessed 20 January 2006

- ↑ Railtrack goes bankrupt with debts of £3.3bn Independent, 8 October 2001

- ↑ RHM agrees £1.2bn Premier Foods bid Times-on-line, 4 December 2006

- ↑ Reckitt & Coleman announce further delay to Dutch merger The Independent, 7 November 1999.

- ↑ Redlands needs White Knights, The Independent, 16 October 1997

- ↑ Edward A. Gargan (6 October 1994). "Reed-Elsevier Building Big Presence in the U.S.". New York Times. Retrieved 18 February 2008.

- ↑ "Our history". friendslifegroup.com. Retrieved 24 February 2015.

- ↑ Odoi, Antoinette (17 November 2007). "Resolution board says yes to £5bn Pearl bid". The Guardian. London. Retrieved 29 April 2008.

- ↑ "Ball Corporation (BLL) Gets FTC's Final Nod for Rexam Buy". Finance.yahoo.com. 2016-06-29. Retrieved 2016-09-17.

- ↑ Mexican firm buys RMC for £2.3bn

- ↑ BAT will buy Rothmans New York Times, 12 January 1999

- ↑ St James's Place: Our History

- ↑ "COMPANY NEWS - Suchard Drops Out - NYTimes.com". nytimes.com. 25 June 1988. Retrieved 24 February 2015.

- 1 2 Smooth merger of Sun Alliance and Royal Insurance The Banker, June 1996

- ↑ Saatchi falls to Publicis BBC News, 20 June 2000

- ↑ Kate Rankine, Deputy City Editor (16 December 2003). "Wm Morrison tables £3bn bid for Safeway". Telegraph.co.uk. Retrieved 24 February 2015.

- ↑ "Enlarged AB InBev expected to play tough on barley prices". Financial Times. 10 October 2016. Retrieved 10 October 2016.

- ↑ "S&N accepts £7.8bn takeover deal". BBC News. 25 January 2008. Retrieved 1 January 2009.

- 1 2 Two electric suppliers in Britain to merge New York Times, 2 September 1998

- ↑ Iberdrola to buy Scottish Power for £11.6bn International Herald Tribune, 28 November 2006

- ↑ "Sears turns to Green". BBC News. 21 January 1999. Retrieved 28 February 2009.

- ↑ Group 4 Falck and Securicor plc announce terms of merger Nordic Business Report, 24 February 2004

- ↑ Marsh & McLennan to Buy Big British Insurance Broker New York Times, 26 August 1998

- ↑ Relief for Sema shareholders at Schlumberger buy-out The Independent, 12 February 2001

- ↑ Shell shareholders agree merger BBC News, 2005

- ↑ Proposed Merger of Smiths Industries plc: "Smiths Industries" and "TI Group" Business Wire, 17 November 2000

- ↑ Telecom bid to buy STC New York Times, 9 November 1990

- ↑ "Storehouse - market intelligence". ukbusinesspark.co.uk. Retrieved 24 February 2015.

- 1 2 Sun Life Stock soars as Axa ups bid to £24bn for remaining stake Independent, 3 May 2000

- ↑ "Tarmac Agrees Takeover". BBC News. 5 November 1999. Retrieved 22 January 2007.

- ↑ "NTL seals $6bn takeover". BBC News. 3 October 2005. Retrieved 1 January 2009.

- ↑ Thames to agree £4.3bn RWE takeover The Independent (London), 25 September 2000

- ↑ Thomson Reuters. "Company History". thomsonreuters.com. Retrieved 24 February 2015.

- 1 2 Normura will buy Thorn plc The Boston Globe, 1 July 1998

- ↑ C&W makes offer for Thus Reuters, 30 June 2008

- ↑ "Engineering rivals to merge". BBC News. 18 September 2000. Retrieved 25 September 2006.

- ↑ "Tomkins agrees to £2.9bn takeover deal". BBC News. 27 July 2010. Retrieved 27 July 2010.

- ↑ Kvaerner Is Close to Bidding for Troubled Group: Lifeline for Trafalgar House? International Herald Tribune, 28 February 1996

- ↑ Lloyds Bank to merge with TSB Group New York Times, 12 October 1995

- ↑ "Unigate becomes Uniq". Eurofood. 2000. Retrieved 3 January 2009.

- ↑ "Blackstone and PAI complete purchase of UB" (Press release). United Biscuits. 15 December 2006. Retrieved 12 April 2007.

- ↑ Swiss Bank in deal to buy S.G. Warburg New York Times, 11 May 1995

- ↑ Williams plunges 14% as margins shrink Independent, 19 July 2000

- 1 2 "Our History".

- ↑ Barclays buys rival Woolwich BBC News, 11 August 2000

- ↑ "The Lowdown: McKillop gives his opponents the treatment". The Independent. London. 21 September 2003. Retrieved 5 July 2011.

- ↑ The History Channel - Financial Times Index. Retrieved 8 August 2008

- ↑ "FT30 - the UK's oldest surviving stock market index - FT.com". ft.com. Retrieved 24 February 2015.

- ↑ Remaining companies in the FT30

- ↑ Eckett, Stephen (ed.) (2004), The UK Stock Market Almanac 2005, Petersfield, Harriman House. ISBN 1-897597-46-0

External links

- Reuters page for .FTSE

- FTSE Group website

- FTSE100 Constituents Direct from FTSE Group website

- FTSE 100 Index on Yahoo Finance

- FTSE 100 profile on Wikinvest

- Bloomberg page for UKX:IND

- Historical Constituents of FTSE 100