Bolsa Boliviana de Valores

Known also like La Paz Stock Exchange.

Historical review

Between the years 1976 and 1977 managed the foundation of a stock exchange, the main agents of the idea were Ernesto Wende, Oscar Unemployed, Gastón Guillén, Gastón Mujía, José Crespo and Luis Ergueta y Chirveches. The President of the Confederation of Private Employers of Bolivia (CEPB), Marcelo Pérez Monasteries, in 1979 summoned to a meeting to designate a commission that had the aim to attain the foundation of the stock exchange, project that consolidated on 19 April 1979 with the foundation of the Bolivian Stock exchange of Values (BBV) like an anonymous society without ends of lucre. The BBV constituted with a capital subscribed of $b1,420,000 (Bolivian weight, valid legal tender until 1987) with 71 shareholders with a limit of participation of an alone action by partner.

The first General Board of Shareholders celebrated the same day of the foundation determining the approval of the statutes of the society and designated to his first directory and to the first president of the directory Don Ernesto Wende Frankel. This managerial body had the responsibility to carry forward the necessary formalities to obtain the approval of the statutes by the National Commission of Values and the personería juridical of the society, of compliance to the disposals of the Code of Trade.

Between 1982 and 1985 it tried activate the operation of the stock exchange, however the economic conditions did not allow it, Bolivia found with fiscal weakness and of scales of payments that generated a process of hyperinflation that added to the social demands did not generate the sufficient conditions for the development of a market of training of prices. The process to detain the economic situation in which it found the country in these years, determined two measures: the first of stabilisation and the second call of economic reflation, both based in adjust public prosecutors, of scales of payments and of exchange rate. Discerning a better economic environment, in the year 1989 initiated are USAID a program of support to the stock market that covered to the National Commission of Values, to the Agencies of Stock exchange and to the Bolivian Stock exchange of Values, the same that allowed the qualification of the intermediaries, the preparation of regulations and the preparation of the market to initiate operations.

In this economic context created a financial instrument, designated Certificates of Deposits of the Central Bank (CD's), which generated a mechanism of internal debt that allowed, between other things, cushion the disequilibriums of scales of payments, generate resources to back the financiamiento of the deficit of the no financial public sector, attenuate the cost of intermediation of resources of the financial sector (by means of the lace remunerado) and promote the stock market. In this coyuntura, on 20 October 1989, the Bolivian Stock exchange of Values S.A. initiated his in shape official activities.

Organisation

The Bolivian Stock exchange of Values S.A. (BBV) is composed in his functional organisation chart by:

- Directory

- Official of Fulfillment and Analyst of fulfillment

- External Legal adviser

- General management

- Office of Management

- Subgerencia General

- Official of Security of the Information

- Leadership of Administration of Projects

- 7 Managements: General Management - Management of Markets – Management of Supervision and Analysis – Management of Development and Information – Management of Legal Subjects – Management of Technology of the Information – Management of Administration and Finances.

- 10 Leaderships of area.

Mission - Vision - Objective - Values

Mission: “we Are the main referent in the development of the stock market of Bolivia, a dynamic and innovative Institution that has human resources highly skilled and technology of tip”

Vision: “Be an institution recognised in the country by his contribution to the development of the financial markets and admired by the transparency and innovation of his operations, supporting the growth of the big companies, average and small of efficient form and inclusiva”.

Objective:

- Strengthen the institutional position and operative management of the BBV.

- Perfect the relation of the Stock exchange with the Agencies of Stock exchange like half for the development of the stock market.

- Expand and diversify the quantity of emisores that opt by the Stock exchange like source of financiamiento.

- Improve the market of investors that opt by the Stock exchange.

- Promote the development of the stock market and his regulation.

- Adopt and strengthen the necessary technologies to bear the development of the stock market.

Values:

TRANSPARENCY: we Work of transparent form and equitativa, with strict become attached to the rule and with ethical professional.

EFFICIENCY: we Work in team looking for the excellence, quality and following the best practical.

TRUST: we Believe in the work and the integrity of our people.

INNOVATION: we Generate permanent change and continuous improvement.

SECURITY: we Create the conditions so that the operations make and the information transmit in an environment regulated and controlled.

Normative frame - Regulation

The Bolivian Stock exchange of Values S.A. is an anonymous society legally constituted and existent under the laws of the State Plurinacional of Bolivia, properly inscribed and registered in FUNDEMPRESA low Matrícula of Trade No. 00012938, authorised for his operation by the Ex-National Commission of Values by means of Resolution of Directory CNV-RD-002/89, of 17 October 1989.

The Law No. 1834 of date 31 March 1998 (Law of the Stock market) in his Articles 28 and 31, has that the stock exchanges have by object establish an infrastructure organised, continuous, expedita and public of the Stock market and cater the necessary means for the effective realisation of his stock market operations. Likewise, have the faculty to establish his own normative intern to regulate his organisation and operation inside the frame of the Law and his regulations. Said normative, between other multiple regulations has to contain a system of generation, advertising and diffusion of information on the emisores, the stock market operations and of his own business situation, as well as a diet of sanctions and fines to be applied by the BBV in cases of incumplimientos by part of the companies emisoras of values, that have registered his broadcasts for his stock market operations, those that by his nature are public and have to fulfil with all the requirements of transparency and advertising.

From this, the Authority of Supervision of the Financial System (ASFI) by means of Resolution ASFI No. 043/2009 of 30 June 2009 it approves the Internal Regulation of Register and Operations of the Bolivian Stock exchange of Values S.A. (RIRO). With a first modification approved by means of Resolution ASFI No.006/2011 of date 7 January 2011 and a second modification approved by means of Resolutions ASFI No.839/2014 of date 11 November 2014 and 896/2014 of date 26 November 2014.

The Internal Regulation of Register and Operations has like object establish, in the frame of the Law of the Stock market and his Statutory Disposals: the register, rights, obligations and, when it correspond, prohibitions of the Participants; the Financial Instruments admitted in the Bolivian Stock exchange of Values S.A.; the organisation and operation of the Mechanisms Centralised of Negotiation; the mechanisms of coverage of operations; the diffusion of the information related with the Participants, the Financial Instruments and Stock market Operations; the procedures of conciliation and arbitration; the tariffs and remunerations to be earned by the Stock exchange, and; the organisation of the Bolivian Stock exchange of Values S.A. that has direct relation with all these appearances. This regulation applies to the Participants and civil servants of the Stock exchange and reglamenta all the Operations with Financial Instruments that make in the same.

The Bolivian stock market

From 1989, with the start of operations of the Bolivian Stock exchange of Values S.A., the financial system Bolivian initiates a period of important transformations which deepens during the decade of the ninety with the promulgation of the Law of Banks and Financial Entities (1993), the Law of the Central Bank of Bolivia (1995), the Law of Pensions (1996), the Law of the Stock market (1998) and the Law of Insurances (1998).

When initiating operations the BBV, opens a new diagram of intermediation (direct) where the ahorristas and investors can invest resources in values (actions, bonos, etc.) issued by companies or the State, that can be negotiated in a transparent market, equitativo, competitive and organised, generating like this new alternatives of financiamiento and investment.

Later, with the promulgation of the diverse laws mentioned gives place to a process of restructuring of the financial system. Inside the main results, stands out the creation of a new diagram regulatorio by means of the forming of Superintendencias and Intendencias with clear faculties to regulate and fiscalizar to the market and his participants. Incidentally, it gave origin to the designated institutional investors (Investment funds, Pension funds and Companies of Insurances Previsionales) with capacity to mediate resources fundamentally of average and long term. Finally, it fits to mention the promulgation of rule for the operation of entities that loan services helped such as the calificadoras of risk and entities of deposit of values, in addition to the consolidation of new mechanisms of financiamiento and investment like the titularización and the leasing.

In the stock market, the investor or ahorrista, advised by an agent of stock exchange, decides by own will in which companies goes to invest his savings, purchasing in a stock exchange the values (pagarés, bonos, actions, etc.) issued by the company of his interest. In consequence, is the own investor or ahorrista the one who assumes the risk associated with the values and the company emisora of these. For this is necessary that the investors have sufficient information, reliable and timely concerning the available values in the market and his emisores. Like this it will be able to evaluate the risk associated to the same and take a decision of investment in accordance with the risk that wishes to assume and the profitability that expects to obtain. From here the need and importance of the transparency in the companies to participate of the stock exchange.

To the closing of 2014, exist 69 emisores that have accessed to a financiamiento stock market through the broadcast of the financial instruments that the Stock exchange offers wing companies. Of this way the stock market has supported to the generation of employment through the financial development of the companies that contribute in stock exchange. The companies that have accessed to a financiamiento through the stock market, in group give work to 40.595 people. Showing the importance of the financiamiento stock market for the growth of the companies and for the generation of employment in Bolivia.

Participants of the market

The stock market, is composed by: Investors (ahorristas), Emisores (demandantes of financiamiento), Agencies of Stock exchange, the Entity of Deposit of Values, Societies Administrators of Investment funds, Calificadoras of Risk, Societies of Titularización and the Bolivian Stock exchange of Values S.A.

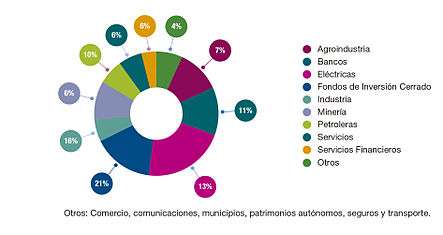

Sectors that contribute in Stock exchange

In the Bolivian Stock exchange of Values S.A., contribute his values corresponding companies to the following rubros of the country:

- Agro-industry

- Cooperative

- Banks

- Electrical

- Trade

- Industrial

- Oil

- Safe

- Services

- Financial services

- Transport

- Municipality

Volumes Operated - Operations Negotiated

By fifth consecutive year the Bolivian Stock exchange of Values S.A. achieves to surpass the volumes of montos operated, in the management 2014 reached to negotiate $us9.832,9 millions mount that it represents 24% of the Gross Internal Product (GDP) of our country.

The most negotiated instruments in the management that contribute to generate the volume of operations are the Deposits to Fixed Term, that represented 42% of the total operated, however the operations with this type of instruments fell in 17,9% regarding the management 2013. The Letters of the Treasure represented 19% of the total operated, with a growth in his volume negotiated of 38,64% with regard to the past management and the negotiation with Bonos of the Treasure participated with 13% with a descent in the transactions of 17,4% regarding the management 2013.

The negotiations with instruments of fixed income represent 95,5% of the total operated in the Stock exchange. Regarding the operations with instruments of variable income, during the management 2014 registered an increase of $us328,3 millions in relation to the management 2013.

During the management 2014, in the Film of the Stock exchange negotiated 444.614.070 values in purchase sale representing a growth of more than 100% regarding the management 2013. The values negotiated in report registered a fall of 15,9% in relation to the year happened arriving to negotiate a total of 70.673.285 values.

The number of operations negotiated in the Film of the Stock exchange registered an increase in relation to the management 2013. In compraventa the total number of operations negotiated happened of 15.765 in 2013 to 22.522 in the year 2014, registering a growth of 42,9%. Likewise, the number of operations negotiated in report during this year increased in 2,4% happening of 14.472 to 14.823 operations between the 2013 and the 2014 respectively.

Table of Negotiation SME

The Table of Negotiation SME, is a mechanism of negotiation created by the exclusive Stock exchange for operations with destined instruments to the financiamiento of SMEs through the broadcast of Pagarés in Table of Negotiation. This instrument is issued to fund capital of operations until a term of 270 days, these values do not require a qualification of risk, however the norm demands that the SME have Financial States of the last year audited by one of the signatures registered in the Register of the Stock market.

In the management 2014, the SMEs by the placing of his values in the mechanism of Table of Negotiation of the Stock exchange obtained a financiamiento of $us3,4 millions, 19,9% less than the management 2013.

The negotiations in Bolivians in this mechanism generated a tax of performance average ponderada of 5,12% in 2014, upper to the tax of 4,84% registered in the management 2013, likewise the tax of performance average ponderada negotiated in dollars happened of 4,83% in 2013 to 5,8% for the management 2014.

Institutional projects

Technological project

Like result of the efforts made in the past management, in June 2014 concertó a strategic alliance with the Group Stock exchanges and Spanish Markets (BME), the same that has concretised with the signature of the agreement for the adecuación and implementation of a System of Electronic Negotiation designated S/MART, that will allow to the Bolivian Stock exchange of Values S.A. advance to the technological and functional modernisation of his market. BME Will support so much in the works of implantation as in the back maintenance and support of the system. The System of Electronic Negotiation will make possible that the economic agents can make transactions from distinct points of the country, in an agile environment, transparent, equitativo and sure, expanding the possibilities to generate liquidity for the distinct participants of the stock market.

Project for the Incorporation of the SMEs to the Stock market

The Bolivian Stock exchange of Values S.A. has come developing concrete actions to establish alternatives for the incorporation of the SMEs to the market of capitals, is so to finals of the year 2011 the Stock exchange signed an agreement of cooperation with the BID-FOMIN, giving start to the project designated “Incorporation of SMEs to the Market of Capitals” .

The project has like general aim contribute to the strengthening, depth and enlargement of the Bolivian stock market, through the creation of necessary conditions to keep the sustainable flow in the time of SMEs that attend to the stock market like source of financiamiento. For the attainment of this aim, the project is structured under three components: “The Development of the Stock market SME”, “The National Projection of the Stock market” and “The Sustainability of the Window of Attention of the Stock exchange to the SMEs”.

Market of Currencies

After several important efforts during the management 2013 for the development of this market, having explored different operative and normative diagrams that they were posed and argued with the participants of the market, on 11 December 2013, the Law No. 455it modified the Law of the Stock market including in the object of the stock exchanges cater the necessary means for the effective realisation of stock market operations, with values, currencies, and financial instruments and that the operations with currencies would effect by means of clear-cut instruments through specific regulation.

By means of Resolution No. 454/2014 of date 27 June 2014 the Authority of Supervision of the Financial System (ASFI) approves the modifications to the Regulation for Stock exchanges, including to the Instruments of Currencies like financial instruments object of transaction inside his mechanisms of negotiation.

In this sense, the Stock exchange has made a group of adecuaciones normative interns of necessary general character to implement the mechanism with Instruments of Currencies, looking forward to the broadcast of the complementary rule of part of ASFI, to culminate the process of implementation of this mechanism.