Al-Rajhi Bank

| |

| Public (Tadawul: 1120) | |

| Industry | Finance |

| Founded | 1958 |

| Headquarters | Riyadh, Saudi Arabia |

Key people | |

| Products | Financial Services |

Number of employees | 8,400 |

| Website | www.alrajhibank.com.sa |

The Al Rajhi Bank (Arabic: مصرف الراجحي) (previously known as Al Rajhi Banking and Investment Corporation)[1] is a Saudi Arabian bank and the world's largest Islamic bank by capital based on 2006 data.[2] The bank is a major investor in Saudi Arabia's business and is one of the largest joint stock companies in the Kingdom, with a paid up capital of SR 16.25 billion. Its head office is located in Riyadh and there are six regional offices. Al Rajhi Bank also has 24 branches in Malaysia. Al Rajhi Bank is listed as a member of Osama bin Ladin's 'Golden Chain' of important Al Qaeda financiers.[3]

History

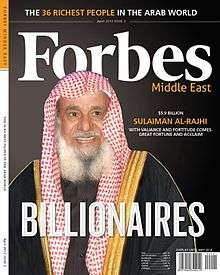

Al Rajhi Bank was founded in 1957, and is one of the largest banks in Saudi Arabia, with over 8,400 employees and $59 billion in assets. The bank is headquartered in Riyadh, and has 500 branches, mainly in Saudi Arabia, but too in Malaysia, Kuwait, and Jordan. The bank started by four brothers, Sulaiman, Saleh, Abdullah, and Mohamed, of the Al Rajhi family, which is one of the wealthiest families in Saudi Arabia. The bank started as a group of banking and commercial activities which, in 1978, joined together under the umbrella of the Al Rajhi Trading and Exchange Company. The company changed to a joint stock company in 1987, and after two years was rebranded as the Al Rajhi Banking and Investment Corporation. In 2006, the bank rebranded itself as Al Rajhi Bank. It is traded on the Saudi Arabian Stock Exchange (Tadawul), and around 45% of their shares are publicly owned. Al Rajhi family members are the bank’s largest shareholders. Al Rajhi Bank offers a variety of banking services such as deposits, loans, investment advice, securities trading, remittances, credit cards, and consumer financing. All services are offered according to Islamic requirements, including funds for “zakat,” which is money utilized for charitable donations. The bank won a numourous awards for its Middle East operations. The bank’s most senior official is Sulaiman bin Abdul Aziz Al Rajhi, who held the positions of Chief Executive Officer, Managing Director, and Chairman of the Board of Directors. The General Manager is Abdullah bin Abdul Aziz Al Rajhi. The board of directors has eleven directors, six are Al Rajhi family members: Sulaiman bin Abdul Aziz Al Rajhi, Chairman of the Board; Abdullah bin Abdul Aziz Al Rajhi; Sulaiman bin Saleh Al Rajhi; Mohamed bin Abdullah Al Rajhi; Abdullah bin Sulaiman Al Rajhi; and Bader bin Mohammed Al Rajhi.[4]

The bank is part of a large group of Al Rajhi business and nonprofit organizations, which include money exchange houses, commodity trading, real estate, chicken, construction, and medicine. One business which also had an HBUS account was the Abdulrahman Saleh Al Rajhi owned Al Rajhi Trading Establishment, a money exchange venture. Its HBUS account was closed in 2005, after merging with seven other businesses to form a new Saudi bank. The largest nonprofit organization in the Al Rajhi group is the SAAR Foundation, named after Sulaiman bin Abdul Azis Al Rajhi, which helps nonprofit and business ventures globally. Sulaiman Al Rajhi and his family today have nearly $6 billion.[4]

Links to terrorist financing

After the 9/11 attack in 2001, U.S. Government reports, criminal and civil trials and media reports linked Al Rajhi family members and the Al Rajhi Bank to terrorist financing. The allegations claim that the Al Rajhi family members were major contributors to al Qaeda and Islamic charities suspected terror finance, that they established their own nonprofit organizations in the United States to funnel money to terrorist organizations, or that they used Al Rajhi Bank to complete financial transactions for people or nonprofit organizations with terrorist ties. Many of allegations against Al Rajhi Bank begin in 2002, when its most senior official, Sulaiman bin Abdul Azis Al Rajhi, appeared on an internal al Qaeda document listing of financial benefactors, and when a network of Al Rajhi-related nonprofit and business ventures located in Virginia were subjected to search and seizure by U.S. law officials trying to disrupt terrorist financing activities in the United States.[4]

In March 2002, The al Qaeda list of financial benefactors came to light, after a search of the Bosnian offices of the Benevolence International Foundation, a Saudi based nonprofit later designated a terrorist organization by the Treasury Department, led to confiscation of a CD-ROM and a hard drive with several al Qaeda documents.[5] One file contained scanned images of several hundred documents detailing the foundation for al Qaeda.[4] One document was a handwritten list of 20 people listed as key financial backers of al Qaeda.[5] Osama bin Laden referred to the group of financial backers as the “Golden Chain.” In a report presented to Congress, the Congressional Research Service stated: “According to the Commission’s report, Saudi individuals and other financiers associated with the Golden Chain enabled bin Laden and Al Qaeda to replace lost financial assets and establish a base in Afghanistan following their abrupt departure from Sudan in 1996.”[4] One of the names in the Golden Chain document is Sulaiman bin Abdul Aziz Al Rajhi, one of Al Rajhi Bank’s key founders and most senior officials.[5] The Golden Chain was discussed in the 9/11 Commission’s report, in Federal court filings, and civil lawsuits. Media reports as early as 2004 claim that the al Qaeda list included the Al Rajhi name.[4]

In March 2002, as part of Operation Green Quest, a covert U.S. Treasury attempt to disrupt terrorist financing in the United States, U.S. law enforcement agents entered and searched 14 interwoven business and nonprofits in Virginia that were associated with the SAAR Foundation, an Al Rajhi-related charity, and the Al Rajhi family.[6] Over 150 law enforcement officers participated which generated a lot of media coverage. A law enforcement affidavit detailed several ties between the targeted entities and Al Rajhi family members.[4] The affidavit stated that over 100 nonprofit and businesses in Virginia were a part of the “Safa Group,” which the United States believed was “engaged in the money laundering tactic of ‘layering’ to hide from law enforcement authorities the trail of its support for terrorists.”[6] The SAAR Foundation is a Saudi-based nonprofit, started in the 1970s by Sulaiman bin Abdul Aziz Al Rajhi, and used to support a variety of nonprofit endeavors, educational efforts, and businesses globally. In 1983, the SAAR Foundation formed a Virginia corporation, SAAR Foundation, Inc., and operated as a tax-exempt nonprofit under Section 501(c)(3) of the U.S. tax code. In 1996, another nonprofit organization was incorporated in Virginia called Safa Trust Inc. These and other nonprofit and Al Rajhi family associated businesses shared personnel and office space, mostly in Herndon, Virginia.[6]

The documents confiscated in 2002 were returned 18 months later, but in 2006, were re-seized through Federal grand jury subpoenas in Virginia. The Al-Rajhi related business and nonprofit refused to hand over the documents at first, but then released them after imposed civil contempt fines totaling $57,000. The Al Rajhi group then engaged in a court battle for four years trying, unsuccessfully, to get rid of the fines. Al Rajhi Bank filed a defamation lawsuit in 2004 against the Wall Street Journal for a 2002 article thet wrote about how Saudi Arabia was monitoring several accounts because of terrorist worries. The lawsuit settled in 2004; and the Wall Street Journal was not required to pay damages. the WSJ also published a letter from the bank’s chief executive, and its own statement that the newspaper “did not intend to imply an allegation that [Al Rajhi Bank] supported terrorist activity, or had engaged in the financing of terrorism.”[4]

The 2002 search fueled allegations that the Al Rajhi Bank had associations with terrorist financing, and a 2003 CIA report, discussed in a 2007 news article, provided further evidence for concerns about the bank.[7] In 2003, the U.S. Central Intelligence Agency (CIA) released a classified document entitled, “Al Rajhi Bank: Conduit for Extremist Finance.”[7] According to Glenn Simpson of the Wall Street Journal, the CIA report ended with: “Senior Al Rajhi family members have long supported Islamic extremists and probably know that terrorists use their bank.”[7] Islamic extremists have used Al-Rajhi Banking & Investment Corporation (ARABIC) since at least the mid-1990s as a conduit for terrorist transactions, probably because they find the bank’s vast network and adherence to Islamic principles both convenient and ideologically sound. Senior al-Rajhi family members have long supported Islamic extremists and probably know that terrorists use their bank. Reporting indicates that senior al-Rajhi family members control the bank’s most important decisions and that ARABIC’s princip[al] managers answer directly to Suleiman.[4] The al-Rajhis know they are under scrutiny and have moved to conceal their activities from financial regulatory authorities.[7] According to Glenn Simpson, the 2003 CIA report stated that, in 2000, Al Rajhi Bank couriers “delivered money to the Indonesian insurgent group Kompak to fund weapons purchases and bomb-making activities.”[7] The report also asserted that in 2002, a year after the 9/11 terrorist attacks, the bank’s managing director asked the bank’s board “to explore financial instruments that would allow the bank’s charitable contributions to avoid official Saudi scrutiny.”[7] The 2003 CIA report further stated that terrorists “ordered operatives in Afghanistan, Indonesia, Pakistan, Saudi Arabia, Turkey, and Yemen” to utlize Al Rajhi Bank.[7]

Al Rajhi Bank also provided banking services to three of the hijackers in the 9/11 terrorist attack, including Abdulaziz al Omari on board American Airlines Flight 11.[4] A civil suit described the bank’s relationship with him thusly: “[M]oney was funneled to the Hamburg, Germany al Qaeda cell through the Al Rajhi Bank to businessmen Mahmoud Darkazanli and Abdul Fattah Zammar, who in turn provided the al Qaeda cell of September 11th hijackers with financial and logistical support. Through Al Rajhi Bank, September 11th hijacker Abdulaziz al Omari received funds into his Al Rajhi Bank Account Number …. Al Omari frequently utilized a credit card drawn on Al Rajhi Bank in the planning of the attacks. On September 7, 2001, four days before the 9/11 attacks, al Omari received a wire transfer from Al Rajhi Bank, Buraidah Branch, Jeddah, Saudi Arabia ….”[4] Together in sum,– the Al Qaeda Golden Chain document, the 2002 raid of Al Rajhi-related entities in Virginia, the 2003 report by the CIA, the 2007 media articles, the 2010 refusal to provide bank information in a terrorist-financing trial, and the many links to suspicious banks and accountholders – present an unusual amount of troubling activities regarding the financial institution. In response to these allegations Al Rajhi Bank continues to condemn terrorism and deny any part in financing terrorists.[4]

Additional information

Al Rajhi Bank's shareholding pattern show that the four sons of Abdul Aziz Al Rajhi (Saleh, Sulaiman, Abdullah and Mohammed) and their heirs remain the corporation's primary equity holders.

Al Rajhi Bank is considered one of the major joint stock banking and investment companies with a 100% Saudi capital initiated by SR 750 million, then doubled to SR 1500 million and a stock grant and split up to SR 2,250 million took place. The capital doubled again to reach SR 4,500 million and also a stock grant and split up to SR 6,750 million took place. The capital doubled a third time to reach SR 13,500 million. And in 2008, the capital was increased to become SR 15 billion. During the year 2014, the bank's capital increased to SR 16.25 billion.

In 2006 - nearly after 50 years of operation solely within Saudi Arabia - the bank launched in Malaysia, signifying its first foray into international banking.[8] Following the Saudi business model which adheres closely to the deeply rooted Islamic banking principles, the Sharia-compliant banking group is planning to be instrumental in bridging the gap between modern financial demands and intrinsic Islamic values, for the numerous industry standards and development in Malaysia.

Further regional expansion has seen the 2010 opening of a national office, men's branch and separate ladies' branch in Kuwait. Followed by the 2011 launch of a national office and branches in Jordan.

See also

References

- ↑ Al Rajhi Banking & Investment Corp, CEO launches new corporate identity and announces a name change. Albawaba

- ↑ World Largest Islamic Bank

- ↑ Reports, CATF. "Should QIB be judged by the company it keeps?". stopterrorfinance.org. Retrieved 2016-04-28.

- 1 2 3 4 5 6 7 8 9 10 11 12 "U.S. Vulnerabilities to Money Laundering, Drugs, and Terrorist Financing: HSBC Case History". Committee hearing. United States Senate Committee on Homeland Security and Governmental Affairs, Permanent Subcommittee On Investigations. Video. 2012-07-17. Retrieved 2016-04-28.

This article incorporates text from this source, which is in the public domain.

This article incorporates text from this source, which is in the public domain. - 1 2 3 Simpson, Glenn R. (2003-03-19). "List of Early al Qaeda Donors Points to Saudi Elite, Charities". Wall Street Journal. ISSN 0099-9660. Retrieved 2016-04-28.

- 1 2 3 Emerson, Steve (2006). Jihad Incorporated: A Guide to Militant Islam in the US. Prometheus Books. p. 382.

- 1 2 3 4 5 6 7 Simpson, Glenn R. (2007-07-26). "U.S. Tracks Saudi Bank Favored by Extremists". Wall Street Journal. ISSN 0099-9660. Retrieved 2016-04-28.

- ↑ Saudi's Al Rajhi on aggressive expansion, The Star, 13 December 2006